You may think that trading indicators are a sign of our times, but the very first inklings of technical analysis emerged in the late 1800s, when Charles Dow came up with the Dow Theory. Today, many investors credit successful trading to technical indicators. If this is the case, what are the best indicators to use in order to ensure your trading success? In this guide, we will take a look at the 3 best indicators to use for day trading. A sensible trading strategy coupled with these indicators can take your trading to the next level. Here they are:

Relative strength indicator (RSI)

Among the most widely recognized and used technical indicators is the Relative Strength Indicator or RSI. It is used by traders to sport oversold and overbought markets. The way this indicator works is very simple. The RSI measures fluctuations in an asset’s price and tells a trader whether the current price trends for that particular asset are fair. It has a value between 0 and 100 and is displayed as a line that floats between two extremes on a graph.

The RSI indicator is used by day traders to look for divergences and convergences. If the indicator’s lows and highs are in sync with the price trend, a convergence will occur. This indicates that the market trend is strong and will most likely continue and vice-versa.

Under normal conditions, the RSI value is between 30% and 70%. Based on this, bearish and bullish signals are generated. Usually, if the RSI is floating around 70%, it indicates that the market is oversold and if it is around 30%, it means it is undersold.

Simple moving average (SMA)

Simple Moving Average or SMA is an indicator that calculates the averages of closing prices for a particular asset. It is updated regularly, and the averages can be examined over a specific time frame.

It is one of the most frequently used indicators in the trading world, and every beginner tends to start their trading journey with a combination of SMA and RSI. It is very simple and easy to use and doesn’t require a lot of technical expertise. In order to learn what the market trend is, just observe the direction of the SMA; if it is moving upwards, so is the asset’s value and vice versa.

An important thing to know regarding the SMA is an indicator that follows the trend and is based on the past data on price movement. For example, the 200-Day SMA and 50-Day SMA mean the price trend is for the last 200 and 50 days respectively.

The SMA is one of the most customizable indicators and can be constructed over long and short-term periods. Resistance and support levels can also be applied to SMA.

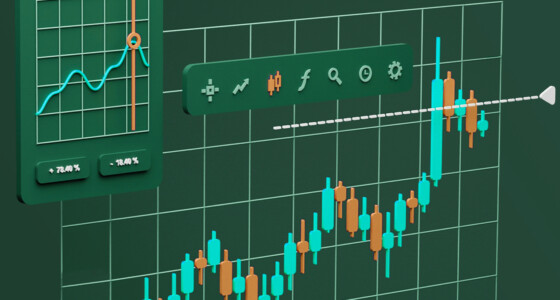

On balance volume (OBV)

Often considered as the best volume indicator for day trading, On Balance Volume or OBV predicts future changes in the price of an asset. It was first developed and applied in 1963.

As indicated by the name, it utilizes the volume flow to predict future trends. The basic idea behind this indicator is that the price of an instrument will be reflected in its trading volume. The OBV helps buyers predict whether the price is going to trend up or down by analyzing the current volume of that particular instrument.

The indicator can have either a negative or a positive value. Traders, however, are not interested in an asset’s actual value. Instead, they are more concerned with seeing the trendline’s direction in order to spot any divergences, reversals, trend confirmations, exhaustion moves, etc.

To sum it up

Technical indicators are powerful tools that can help you make solid decisions and fetch rewards in day trading. The 3 indicators mentioned in this post are accurate, reliable and easy to use. Once you have mastery over these indicators, you can confidently make trading decisions on your own. Using these indicators will allow you to see the market trends and you will be better positioned to make sound financial decisions. Please keep in mind that these technical indicators are just indicators, making any financial investment comes with certain risks and you should always have a backup plan.