History of price action trading

The price of an asset says a whole lot about it. After all, price movement in the global market will determine if there would be a profit or loss. Traders who have made up their minds to focus on studying the prices of assets will need to learn the price action strategy. This will involve studying trends in the market in a bid to ascertain an entry or exit position. However, like every other trading strategy, price action is not a one-way ticket to successful trading. It has flaws and does not assure a loss-free trading experience. Having examined this trading strategy, traders must understand what it is and how to navigate it.

Traders who devote their time to studying the price of an underlying asset in making their decisions use the “price action” strategy. While this has worked for many experts, some traders need help wrapping their heads around it.

Price action trading, what does it mean?

Price action trading is an easy strategy where a trader analyzes the price chart and makes major decisions based on the market price movement. Price action trading is often deployed in place of other factors like technical indicators.

Below are a few factors that highlight the efficiency of price action over technical indicators:

— Trade indicators don’t involve human psychology

— Indicators do not decide the price

— Indicators sometimes complicate the trading process

“Understanding the trade indicators and price movement will help you make the most of the price action strategy”— Yarrim Victor, SNR Price movement consultant.

Why do price action indicators not work 100%?

No trading strategy guarantees 100% trading success, including price action. Every method and approach is designed to identify trends in a volatile market environment. Trading indicators and price action skills help traders detect a trade’s probability of switching price movement to a particular direction.

- Price action indicators cannot evaluate trade volume, which makes it difficult for traders to prepare ahead.

- Market volatility. The dynamics of the market make it difficult for indicators to predict accurately.

- Market trends. Indicators rarely spot an incoming trend.

- Risk response. Price action indicators do not elaborate on risk response.

Mechanism of price action strategy

The profitability of price action trading depends on how well the trader has defined his trading plan. Many professional traders and investors have proven that price action trading can be profitable. Meanwhile, traders who only pay attention to the price chart often ignore vital factors like the news and economic indicators. Because of this negligence, they miss out on important events that may impact the price of their underlying asset. This is one primary reason why price action trading may not work for some traders.

A case study—

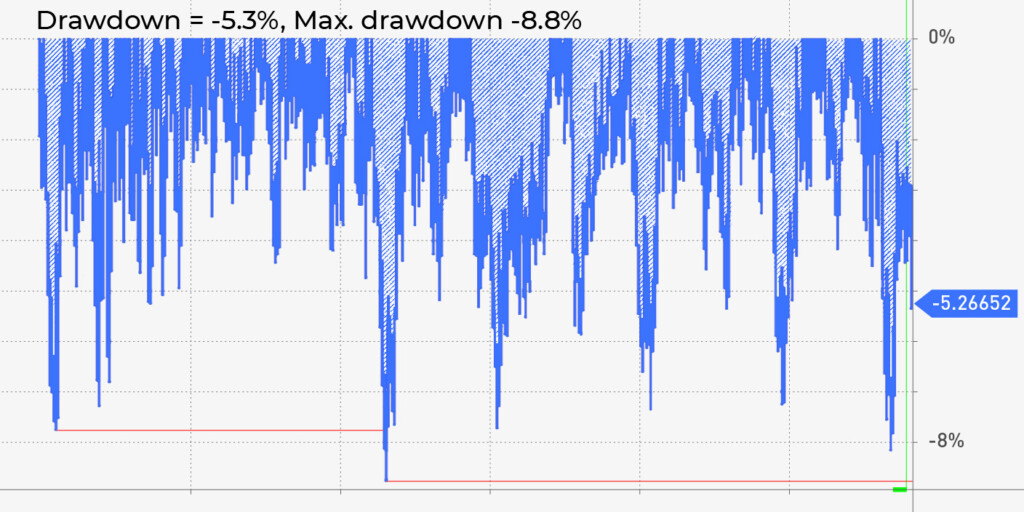

This strategy was initiated with an investment capital of $350,000. The following are the parameters of the test to see if price action trading is profitable:

- Position sizing – 2 Lots

- Transaction/slippage cost – 0.02%

- Total trades – 2680 (22.3 trades/month)

- Accuracy – 41%

- Profit factor – 1.28

- Max consecutive losing trades – 11

- Recovery factor – 9.65

The ending capital of this test strategy is $2,107,433. The conclusion drawn from this test is that the profitability of price action trading depends on the traders’ plan and how carefully the method is executed.

3 Challenges of price action trading

You are a trader who knows what price action trading is, but sometimes you expect to get a pullback to no avail while the price continues to trade higher. Don’t worry. You are not alone. In this section of the article, we will go over the top challenges and three challenges of trading price action so you can be aware of these possibilities.

1. The low number of trades

Trading price action usually takes time because the trader will want to wait patiently for price confirmation at resistance and support levels. However, waiting for price confirmation means the trader will miss out on more trading chances when the prices bounce off the ranks. This could be heart-wrenching at times and explains one of the challenges of this strategy.

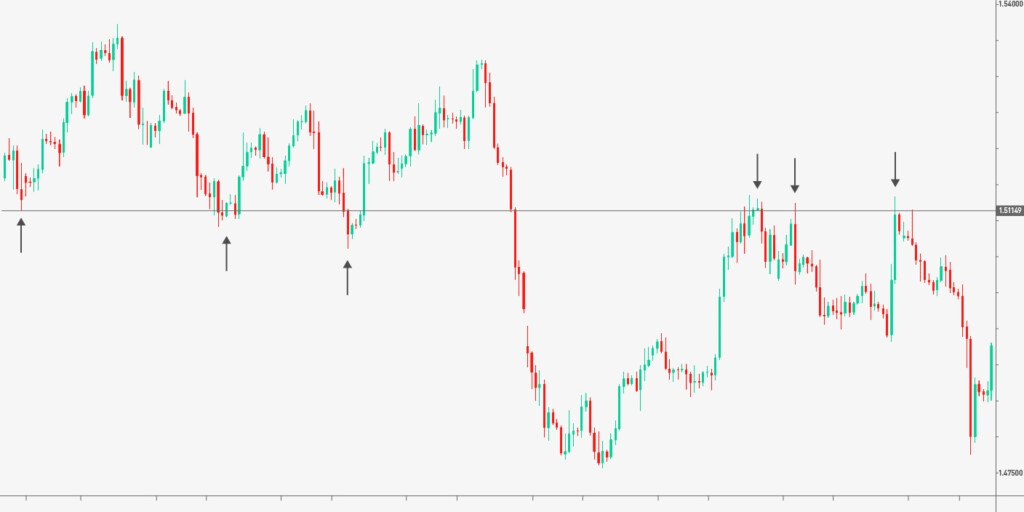

The chart below shows a missed trading opportunity due to continuous high trading prices.

2. Fixed-level entries

Another challenge with the price action strategy is that the trader would always have to wait for the market price to reach their levels. These levels may be current or previous resistance and support. In a trending market, the costs will often not return to test these levels due to underlying momentum. As a result, the trader is sidelined while the market continues in a particular direction.

Below is a typical example from a price action trading:

3. Size of reversal candlestick

The size of the reversal candlestick can also be challenging to price action traders. The primary purpose of a reversal candlestick is to confirm if a level is doing well. Candlesticks come in varying sizes and shapes but are not necessarily equal. If a sizable engulfing pattern means there is a price rejection, what will be the fate of the trader when there is a small pattern which lacks conviction? Could you still open a position?

Why do price action traders fail, generally?

The majority of price action traders succeed and succeed at it. They only get stuck in a limbo of frustration with little or no help to get out. When there is a significant trend in the market, the price action strategy works. On the other hand, when the market is not trending, things tend to go wrong. When it is evident that price action involves trading the trend, why do some traders still need help to break through with this strategy? The answer to this puzzling question is simple. Here are a few reasons why some price action traders fail:

1. Lack of price action understanding

Traders need to first and foremost understand that price action trading is not just about identifying patterns. It takes time to master, as most expert traders confess it took years of practice to get the hang of it. Anyone can learn the fundamentals of technical analysis in just a few days. Applying it, however, in real-life market situations will take time to master. The same goes for price action trading; most traders fail because they need to understand how it works.

2. The danger of overtrading

Next, many traders need help overtrading. A decision driven by the desire to make more profit can easily blind a trader to start opening positions uncontrollably. Suddenly, they begin to see things in the chart that are probably. From this point, the trader loses the invested capital until things get out of hand. At all costs, overtrading should be avoided so that the price action strategy can be effectively applied.

3. Late decision

Another point to consider behind the failure of price action traders is the late decisions. In a bid to wait for confirmation, the trader pulls the trigger too late. Rather than trusting their plan and guts with an adjusted position, they prefer to get proof of the trend before opening. Eventually, they enter late and not only miss out on trading opportunities but also try to blame the price action strategy. The point is that a trader needs to work on a sixth sense when trading price action. This will only come because of experience.

4. Impatience

Lastly, many novice traders must improve because of impatience, even with the price action strategy. Rather than aiming to consistently build a profitable portfolio with a proper risk and money management plan, they resort to looking for a “one-time perfect trade.” Such traders risk more than they can bear and ultimately blow up their trading accounts. Traders must accept loss as part of trading and not look for a “knock it out of the park” trade. Building a consistent portfolio will help to identify when to enter and exit a trade in the long run.

Do professional traders still use price action?

Yes, they do. Price and time are the two things that most professionals look at when trading. Every other item on the chart shows what has happened in the market. Professionals adopt the price action trading strategy without the help of a supporting indicator to get all the information they need to make a decision.

What separates professionals from novices, in this case, is their understanding of how the market works. If you can figure out the mode of operation of the global market, you begin to see trading from a different standpoint. At this point, you quit chasing a perfect trade, and instead, you learn how to maneuver your way around an asset price for your benefit.

Can a price action trader become successful?

Of course, a price action trader can become successful. Many professionals believe that price action trading is the most comprehensive trading method. The significant advantage of this trading strategy is that the market prices are accurate. This means indicators like RSI and MACD are only mathematical derivations and are not in the market. Once you understand this, you can see who is controlling the market. The downside to price action trading is that it takes much time to learn and study, the same as everything worthwhile. Compared to the price action trading strategy, trading with indicators is easy. To succeed as a trader, one should know how to manage a trade correctly.

If the Renko chart maintains the same color in a trend, traders should trade it. But if it reverses, then it may be an exit signal.

The way forward

Price action is considered a trading method requiring time and patience. Although, this method may not work for you in 2023 if you constantly find it hard to commit yourself to the learning process. You can start with learning price action trading, then give yourself the time to build your portfolio consistently.

“The major reason some traders succeed with this method and others do not is their attitude toward price action trading”— Ben Archman Luis, trade analyst.

If you consider this method a time waster, you can opt for technical indicators to guide you through navigation. On the other hand, if you are seeking a more precise and mature way to analyze the market, then price action trading may be your go-to option.

Sources:

CMC Markets: PRICE ACTION TRADING

Trading with Rayner: Price Action Trading, 4 Biggest Problems, and Their fix!

Trading psychology, stereotypes, examples, guide, Investopedia.com

Risk management averse, Economic times, India