To open a trade, you need to set an order. Newbies think all they have to do is click the “buy” or “sell” button. But professional traders know that’s not all. You can place an order immediately or set a price at which the order will be executed. Orders help you exit the market with profit and limit losses.

Many order types can be used in trading in general. According to statistics, stock exchanges and trading companies implement over 300 different order types. Fortunately, you don’t need to use all of them.

What are order types in stock trading? They are the same as order types in Forex trading. Below you will find standard order types that will help you trade successfully.

What is a trade order?

As the name suggests, a trade order is a type of order that you place for trading exchanges. This can include anything from futures contracts to stocks and more. Since stocks are rather volatile, especially in a fast-moving market, a trade order could help you keep things under control.

Trade orders come in different types. You have the market order, the limit order, and the stop order. Market orders are trade orders used to purchase or sell a stock at a certain price. That price is set by the market, so the individual has no control over how much they would have to pay.

Market trade orders have a relatively high slippage risk, especially in a quick-moving market. For instance, if one stock is traded heavily, some trade orders may be executed ahead of you. This can potentially change the price that you have to pay.

Understanding the concept of timing

When it comes to trading, timing means anything. Each order will happen during a specific timeframe. You can choose the timeframe based on the trading platform that you are working with. For the most part, your orders will remain valid within the following timeframes:

· Day Only – Only active for a standard trading session.

· Good Until Cancelled (GTC) – Active for 180 days between 9:30 AM and 4 PM ET until it gets canceled or filled.

· Day + Extended Hours – Active for one standard trading day, from 7 AM to 8 PM ET. Orders placed outside that timeframe will kick in during the next trading session.

· GTC + Extended Hours – Orders are active between 7 AM to 8 PM ET for the next 180 calendar days.

· Extended Hours AM – An order may be placed between 8:05 PM and 9:25 AM, with the session running between 7 AM and 9:25 AM of the next day. (Ext. AM session).

· Extended Hours PM – An order may be placed between 4:05 PM and 8 PM, with the session running between 4:05 PM and 8 PM of the next day. (Ext. PM).

By placing your trades at the right moment, you may be able to enjoy the benefits.

Market order

A market order is an order type that allows a trader to buy or sell an asset at the current available price. Although it seems this order type is the simplest, as a trader sees the price at which the trade will be executed, it’s not the case.

In market orders, there is a high risk of slippage. If the market is highly volatile, a price changes rapidly. Thus, the seconds required to set a market order may result in a less profitable price for a trade. However, this type of order works well on stable markets. Moreover, it allows you to buy or sell an asset immediately.

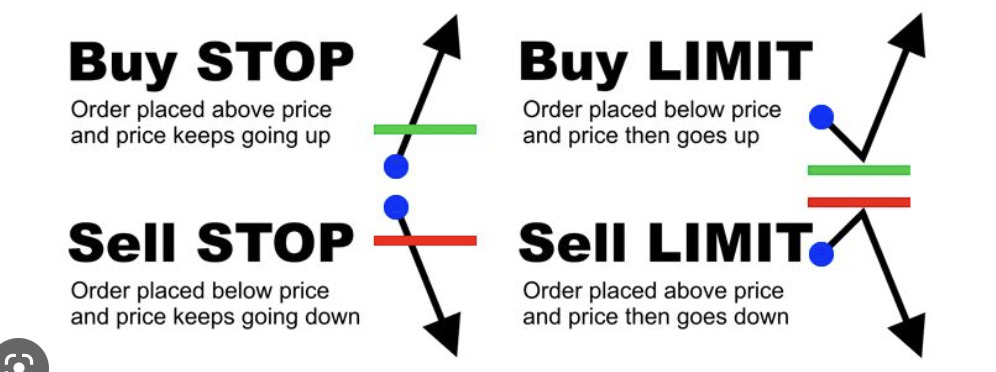

Limit order

A limit order is an order type that allows a trader to set a specific price at which the trade should be executed.

For instance, if the EUR/USD pair is trading at $1.1837, but you think its fair price is $1.1845, you can set a sell limit order at $1.1845 so that a sell trade will execute only if the price reaches that level.

The main pitfall of the limit order is that a trade may be canceled without being executed if the price doesn’t reach the set level. The trade can be canceled automatically and manually.

Stop order

A stop order, also known as a stop-loss order, is an order type that limits losses. It’s one of the order types in trading to exit the market.

Here, it’s worth reminding you how trading works. When you close a buy trade, you sell the asset. When you close a sell trade, you buy the asset. The process is done automatically, so you don’t need to open another trade.

A stop order takes place when you open a buy trade but the price declines and becomes lower than the open price. That is, you sell (close trade) at a lower price than when you purchased an asset. At the same time, when you open a sell trade but the price moves above the open price, a stop-loss order closes the trade. That is, you buy at a higher price.

A stop-loss order allows you to limit losses and close a trade automatically to protect your balance.

Imagine you opened a sell position of EUR/USD at $1.1837, but the price started rising. Before opening a trade, you knew that a rise above $1.1850 would mean your trade failed, so you set a stop-loss order at $1.1850. It means you would lose only 13 pips per trade instead of losing all your funds.

Limit orders versus Stop orders

Limit orders are orders to sell or buy stock following a restriction. For instance, if you have a maximum amount that you are willing to pay, limit orders can be useful. A stop order, on the other hand, is an order to buy at a stop price that you expect will reach. If the stop price is not reached, the order will not be executed. Both orders are great if you are planning to make the most of your capital and minimize losses.

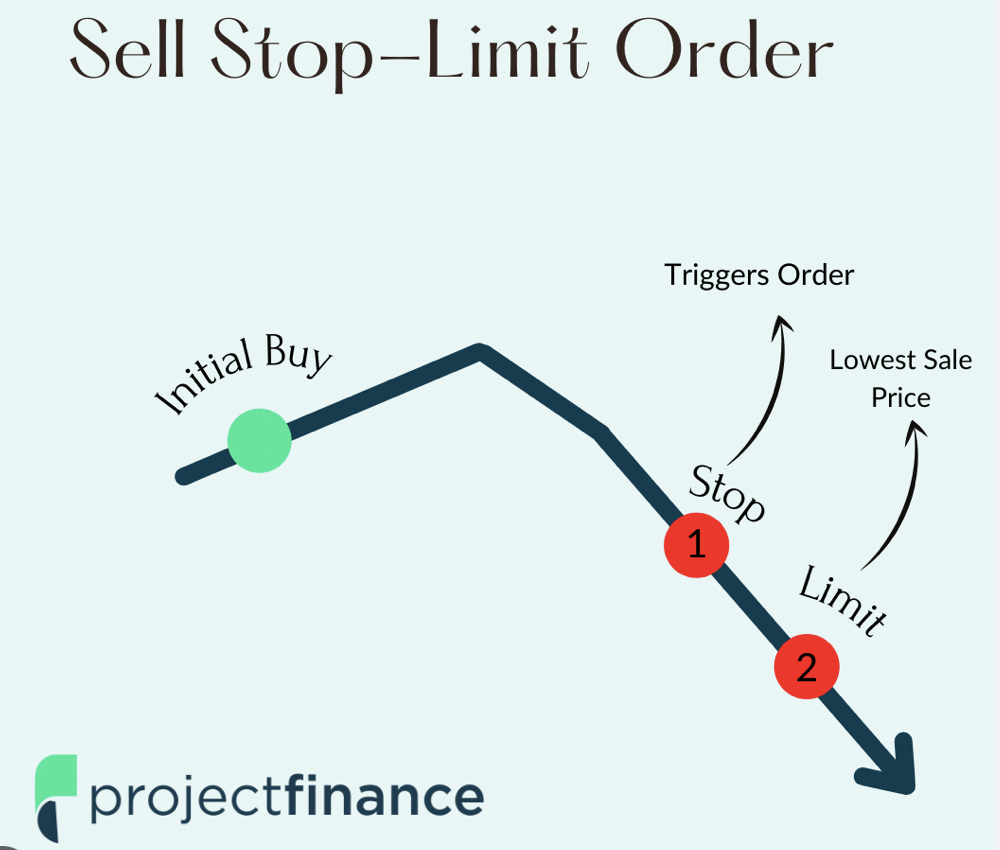

Stop-limit order

A stop-limit order combines the features of limits and stop orders. Therefore, you need to set two prices.

For instance, the EUR/USD pair is trading at $1.1837. You set a stop price at $1.1830, while a limit price is $1.1825. If the pair falls to $1.1830, the order turns into the limit order. But you will sell if only the price is lower than $1.1830 but higher than $1.1825. That is, the order will be executed at the limit price or better.

Unlike a stop-loss order, the stop-limit order mitigates risks of highly volatile markets when a price may recover fast.

Take-profit order

A take-profit order is an exit order, but unlike stop loss, it allows trades to be closed automatically with profit. Although you can close trades manually, setting take-profit and stop-loss orders is recommended so that you never miss the right point to exit the market.

Before entering a market, you determine an asset’s price you would be satisfied with. For instance, you buy EUR/USD at $1.1837, and you think selling the pair at $1.1900 would be a considerable profit. Then you set a take-profit order at $1.1900. If the price reaches this level, the trade will be closed automatically with profit.

The risk of the take-profit order is that the price may not turn around before it reaches your target. Then, you will bear losses.

Should you use different order types in trading?

You should use various order types in trading regardless of the asset you trade. While it’s up to you whether to open a market order or a limit order, you should always set stop-loss and take-profit orders to limit losses and take your profit at the best possible rate.