Did you know that saving money can actually be contagious? Studies have shown that when people observe their friends or peers engaging in money-saving behaviors, they’re more likely to adopt similar habits. This phenomenon is known as the “bandwagon effect.”

So, as you prioritize saving, budgeting wisely, and making sound financial decisions, you become a role model for those around you. And this post will touch on the best money saving apps to help you improve your own financial situation (and possibly free up more funds for Binomo trading) and inspire a positive wave of change in your community. Here’s what you should download this month:

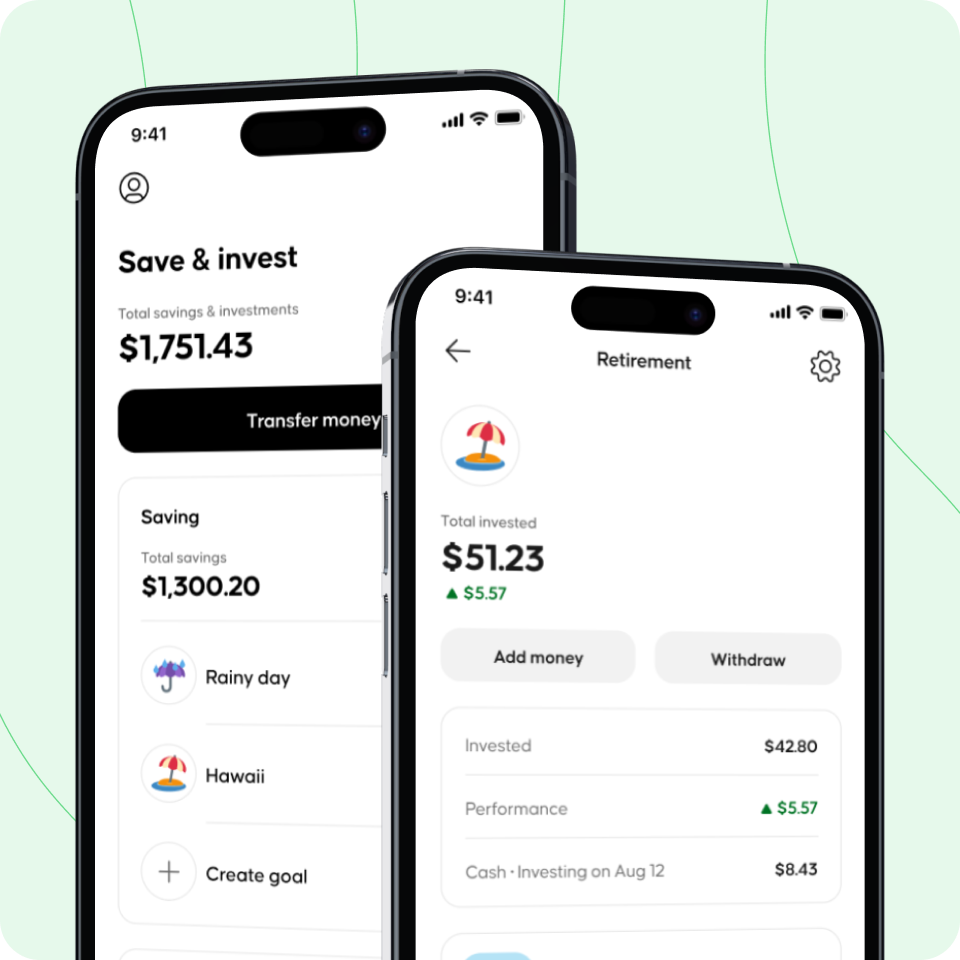

Oportun (Digit)

On average, Oportun (formerly Digit) members have reported doubling their liquid savings within a year of signing up. The app achieves this by linking to a user’s bank accounts and employing algorithms to calculate savings amounts based on their income and spending patterns.

Oportun has earned recognition for its credibility and reliability. It boasts an A+ rating from the Better Business Bureau (BBB) and has been honored with the distinction of “Best Consumer Product” by Fintech Breakthrough, acknowledging its impact and effectiveness in the industry. Moreover, Oportun holds a notable certification as a Community Development Financial Institution by the U.S. Treasury Department.

After a 30-day free trial, the app charges a monthly fee of $5. While this fee may be a consideration, it’s important to weigh it against the potential long-term benefits.

Qapital

One of the best apps to save money is Qapital, a straightforward application that offers a light range of features without overwhelming users.

It offers a 30-day free trial, and different subscription plans at varying price points later on. The Basic plan is priced at $3 per month, the Complete plan at $6 per month, and the Premier plan at $12 per month. With Qapital’s Basic plan, for example, users have the ability to create unlimited, personalized savings goals, set up rules that trigger automatic savings, transfer money between goals, and rely on FDIC insurance for up to $250,000.

One notable feature of Qapital is the ability to apply rules to each savings goal, contributing to a sense of gamification and more enjoyable, motivating experience. Additionally, users can create shared savings goals if they want to involve a partner or friend.

Chime

One notable feature of the Chime app is the high-yield chime savings account, which offers a competitive 2% Annual Percentage Yield. Also, the savings account doesn’t impose maximums on interest earned or require a minimum balance for better flexibility.

Chime provides two options for saving money. The app offers Round Ups, which automatically rounds up their amount to the nearest dollar and depositing the difference into their savings account. Another automated savings program is called Save When I Get Paid, which saves a percentage of each paycheck.

In addition to automated saving options, Chime allows unlimited transfers from the savings account to the checking account. And there is a cash deposit feature, allowing users to conveniently deposit cash into their Chime account.

Mint

Mint is a free-to-use app that provides a high-level overview of a user’s financial health. The app allows you to sync your financial accounts so that you could track your transactions and categorize them, simplifying the process of monitoring your spending habits.

Another feature allows users to add tags and reorganize transactions as needed. Moreover, users can separate a single transaction into multiple categories, including any associated fees charged. One of the key benefits of using Mint is the ability to gain insights that highlight easy opportunities to save; in other words, the app provides personalized recommendations and suggestions.

If you’re looking for a more powerful tool, an enhanced version called Mint Premium is available exclusively on iOS devices for $4.99/month. You’ll get advanced analytics, the option to export your data, and access to Billshark.

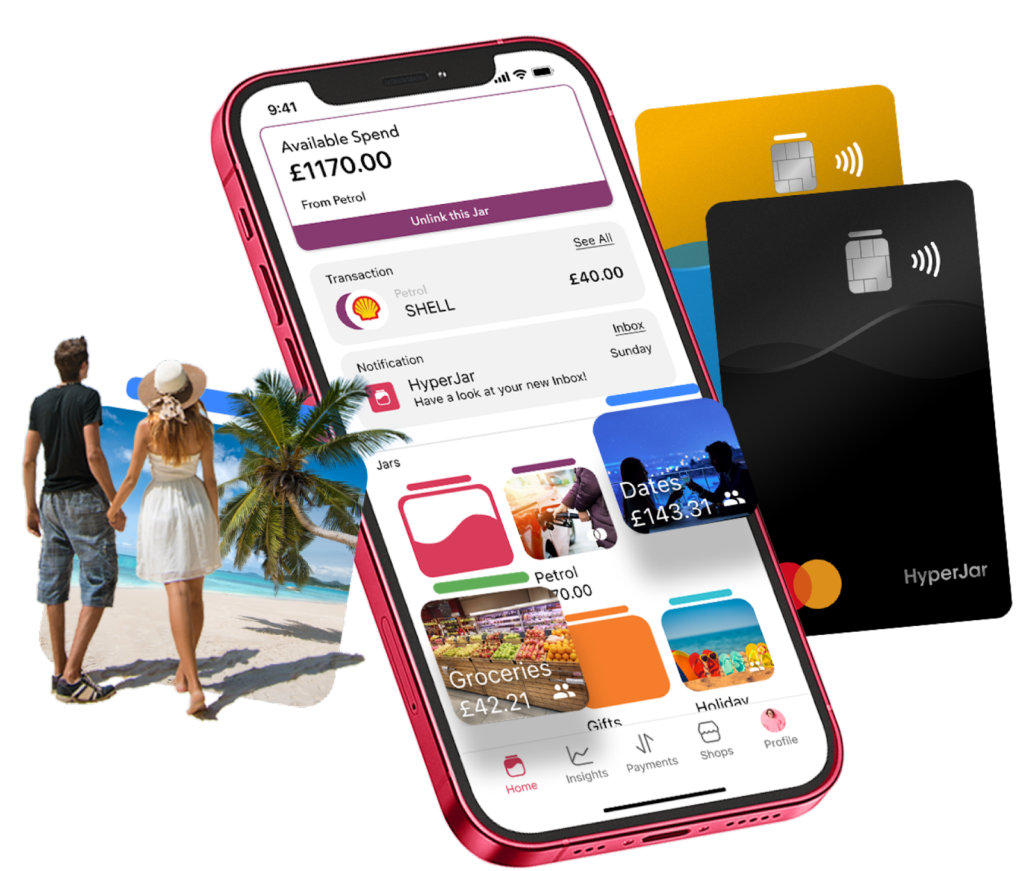

HyperJar

HyperJar provides users with a prepaid Mastercard card and a free corresponding app. With it, users have the flexibility to divide their money into virtual jars or pots, which makes for easy budgeting and allocation of funds. The app allows them to spend from different jars automatically using a single card.

There is a notable aspect of partnerships with popular companies, such as eBay, Shell, and Skyscanner. Through these partnerships, users can enjoy special discounts and benefits when making purchases through HyperJar.

HyperJar extends its functionality to family budgeting as well. The app allows users to give pocket money to their children and track their spending, making it a valuable tool for managing finances together as a family.

Tally

While it’s on the pricier side at $25 per month, Tally can be a worthwhile investment as one of the best money apps to become debt-free. One of the key features is activity monitor to simplify and organize card payments. This streamlines the process of managing multiple card payments, so you should find it easier to stay organized and avoid missed or late payments. It also functions as a smart bank card manager, assisting users in optimizing their card usage and payments.

Many praise Tally for its personalized payoff plan. The app analyzes your debt and financial situation and creates a customized plan to help you pay off your debts more effectively. With such a clear roadmap, users feel more empowered to take control of their debt and work towards financial freedom.

So, whether you prefer the convenience of a high-yield savings account like Chime or the automation offered by apps like Oportun, the key is to select an option that suits your lifestyle and financial goals. With apps like these, it might become easier to set yourself on the path to financial success. But you definitely have to put in real effort to actually save a meaningful amount, just as you need to dedicate time and commitment to achieve good results on Binomo.

Sources:

Bandwagon effect, Wikipedia

Do money saving & budgeting apps really work? Unbiased