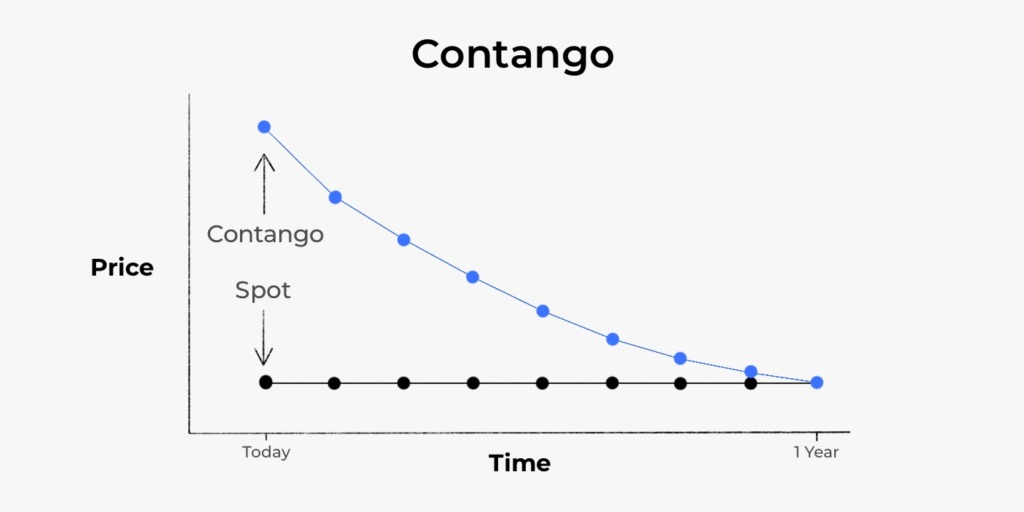

Contango is a situation in the market where an asset or commodity has a future price that tends to be more than the spot price as maturity approaches. Defined, the whole aim of the Contango Strategy is that the futures price will converge with the spot price as the delivery date arrives.

Contango can be further viewed as the typical market expectations for a futures contract. This happens because the future asset price will traditionally account for the spot price and the “cost of carrying.” This makes it more than the spot price, based on the maturity time.

What is a backwardation strategy?

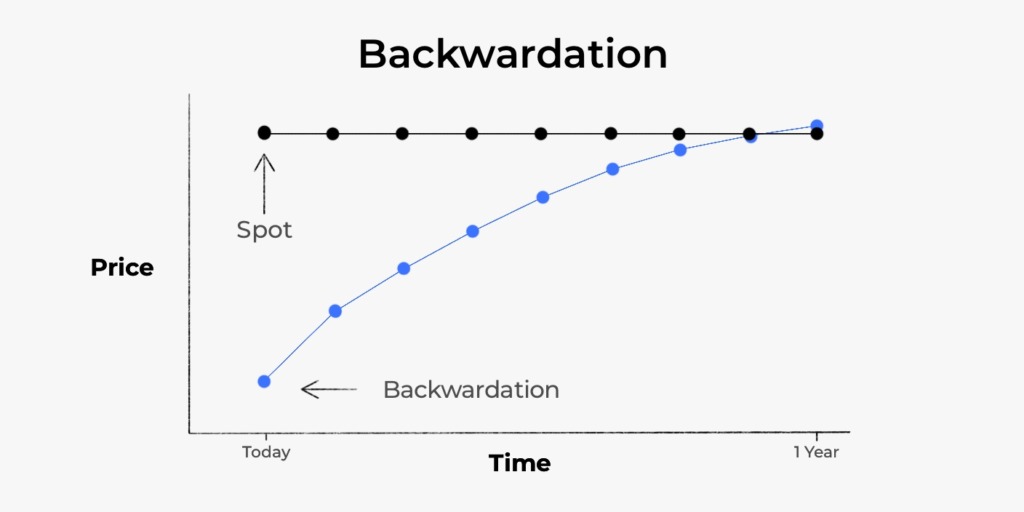

The Backwardation Strategy is the opposite of Contango. In Backwardation, the market experiences a commodity’s lower futures price than the spot price. Backwardation is often confused with an inverted futures curve which is wrong.

When the spot price of a commodity or asset becomes higher than the future price, such commodity or asset is said to be in Backwardation. This is often due to the scarcity of commodities in the market.

Contango vs Normal backwardation: an overview

The futures curve shape is very important for commodity speculators and hedgers. Most of the time, they will want to know whether the market is a contango or a backward one. Very often, they look similar, but they are quite different in their roles.

Normal backwardation and contango markets refer to the price patterns over time. If the prices are rising or falling, these curves will show a visual representation of that.

In 1993, the Metallgesellschaft Company was famous for losing more than 1 billion dollars. This happened simply because their management used a hedging system that relied on normal backwardation. The problem was that their system did not anticipate the changes in the contango market as well.

Backwardation and contango markets define the forward curve structures. If the market is found in backwardation, then the forward prices of the concerned futures are lower in comparison to the spot price. On the other hand, if the market is in contango, the opposite happens: the future’s contract price is higher in comparison to the spot price.

Key differences

Futures markets are considered normal in one scenario: the future’s prices need to be higher when they’re at a lower maturity. Otherwise, if those prices are lower and at a distant maturity, the market is considered inverted.

The concept can be quite tricky to understand, especially if you are a beginner. Before going into the differences, you need to grasp a few ideas: contract maturity and rational futures prices.

When you get close to contract maturity while investing, the price of the futures needs to converge or move in the direction of the spot price. At that point, the futures contract may be either short or long of what you expected.

The difference between the two is made clear by the basis. On their maturity date, the price of the futures has to match the exact spot price. Unless they converge, anyone can use easy arbitrage to make money off of it.

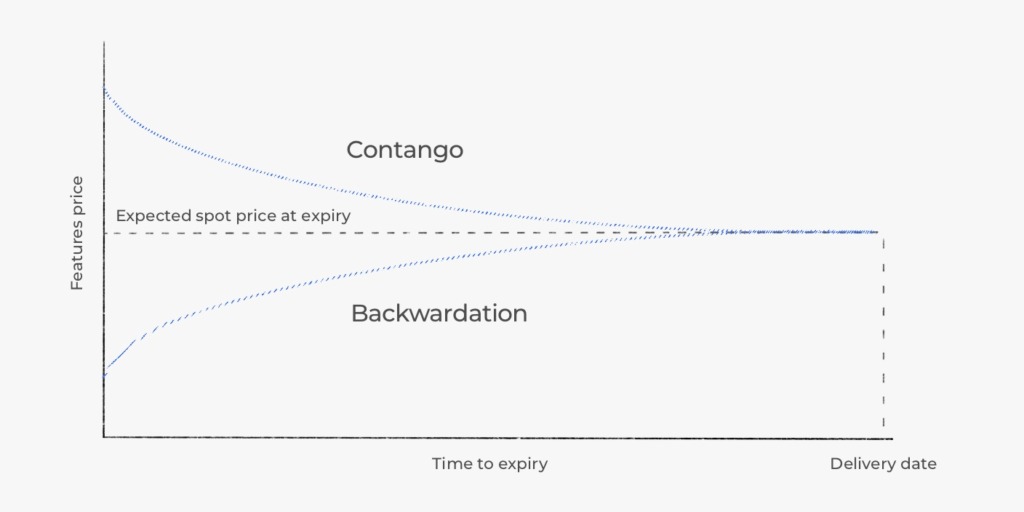

As a trader, you may also need a bit of foresight. The best futures price is known as the “spot price,” which you expect to reach in the future. For example, if you foresee that the crude oil prices would reach $85 within a year, then the rational futures price would be $85 as well. Anything that is above or below that can signify a loss.

This is where the suggesting lines come in. If your futures price is above the expected spot price, you are in a contango market. This implies that the prices will fall over time. That being said, if the price is below the expected position, you are in a normal backwardation market. It means that the prices of futures are increasing.

Why are contango and backwardation important?

The direction of the market is very important, especially among those investing in physical fuels. This will suggest whether they have a chance of success in the future or not. Knowing both these lines will tell you what your chances for profit or failure are.

If the market is in backwardation, it means that the prices of the futures are lower than they currently are. This should give an incentive for the investors to sell their assets before the prices fall even more. On the other hand, if it’s contango, it means that tomorrow’s prices are higher. This suggests that holding onto those assets may be a better decision.

Knowing both graphs will help you come to a decision so that you may increase profit and minimize losses.

Contango examples

As mentioned, contango markets happen when the futures prices go above the spot price. For example, let’s say that you have a futures contract for December 2023 that is worth $100.

Now, let’s fast-forward a month. The spot price could as well have remained at $100. However, if the futures price went down to $90, not matching the futures spot price, it suggests you have entered the contango area.

Backwardation examples

Backwardation is like the opposite of contango. Let’s take the December 2023 contract once again. If the futures price went to $90, you now know that you would be in a contango market.

However, if the futures spot price is at $100 and the future’s price reaches $110 in a month, you are in a normal backwardation market.

Contango vs backwardation: the trading trends

Traders can employ any of these strategies to reach their goals. Investors often take advantage of Contango or Backwardation when speculating the futures price of an asset with the spot price at maturity.

Market conditions and trends are needed for traders to make smart trading decisions, especially on whether to go long or short. This is achieved by carefully monitoring the expected price movements of commodities and market factors. The ultimate goal is to profit as the futures price and spot price converge on the delivery date.

In Contango, investors are willing to invest more in a commodity with an eye on its future spot price or wait for an arbitrage. A Contango may be allowed to depreciate the underlying asset’s value as it approaches expiration. Often, traders do this to buy a commodity to sell off at a higher future price. Traders can also decide to swap markets to sell commodities with their price differences or movements.

This trading mechanism influences the flow or the downflow of the market predicated on the probability of convergence. Notably, when the market is in Contango, traders sell more as it is in premium, while during Backwardation, traders tend to buy more. This is because, in Contango, there is a current surplus in supply, while in backwardation, the demand is in surplus.

Is backwardation bullish?

Backwardation is not bullish in itself since there is no increase in the commodity price. It depends on how a trader approaches the market. If a trader, due to desperation, indulges in selling off without careful monitoring, the market might seem bullish to the trader. However, if a trader accurately defines when to buy and accumulates the cost of carrying with the eventual convergence, he will profit from the market.

Moreover, the contract delivery time can also influence the nature of the Backwardation. If it is a short-term Backwardation, traders expect supply to ramp up while it lingers, which can incur severe inflations, making the Backwardation Bullish.

Is backwardation bearish?

Backwardation is Bearish if short-term but will turn bullish over an extended period. Moreover, a trader’s approach to the market can decide how a trading strategy like Contango vs. Backwardation will turn out for him.

In other words, Backwardation is Bearish but will turn bullish in arbitrage as it reaches futures contract delivery.

In conclusion

For effective financial modeling, a trader should approach the market with the right attitude. Astuteness is needed when monitoring and exploring an underlying asset’s price movements and supply. Traders who may not want to harness the market’s potential during Contango or Backwardation can annex the profits in arbitrage.