In the ever-evolving world of trading, there are many tools and strategies that traders use to navigate the financial markets. One such tool is the Doji candlestick pattern. Doji candlesticks are essential to understand as they often signal potential reversals in price trends. These Candlestick patterns act like the language between the traders and the trading sites, providing valuable insights into potential price movements.

In this comprehensive guide, we’ll dive into the world of Doji candlesticks, understand the Dragonfly Doji and Gravestone Doji variations, and provide practical insights on how to trade these patterns effectively.

What Is a Doji Candlestick?

A Doji candlestick is a vital component of technical analysis. It forms when the opening and closing prices of an asset are nearly the same. It is characterized by its unique appearance. It forms a small-bodied candlestick with a horizontal line or a “cross”. This equilibrium suggests indecision in the market, where neither bulls nor bears have a clear upper hand.

This indecision in the market leads to the formation of a candlestick with a very short body and long upper and lower wicks or shadows. The following image clearly shows the shape the candlestick will make. If you look carefully, you will observe that the body is very short, and the wick is long on both sides of the body. A point to be noted is that the opening and the closing price is nearly the same.

Well, Doji candlesticks can be classified into various types, each with its own significance. However, the two common variations of the Doji are the Dragonfly Doji and the Gravestone Doji. These patterns are particularly important as they often signal potential reversals in the price trend. These patterns have their own characteristics and potential implications for traders. We will talk about them in the following paragraphs.

The Dragonfly Doji: Definition and How to Trade It

As you can see below, the Dragonfly Doji candlestick is characterized by a small body with a long lower shadow or wick, resembling a dragonfly. It forms when the opening, closing, and lowest price of a trading session are nearly identical, while the highest price is notably higher. Visually, it resembles a “T” or a “cross”, with a long lower shadow and little to no upper shadow.

The Dragonfly Doji is a distinct Doji variation that carries significant importance in technical analysis. This pattern often appears after a downtrend and signals a potential reversal to the upside. It suggests that despite the bearish pressure, buyers managed to push the price back up by the end of the trading session.

How to Trade a Dragonfly Doji Candlestick

When you encounter a Dragonfly Doji candlestick on your price chart, it indicates a potential bullish reversal. It implies that after a downtrend, the market may be losing its bearish momentum, and a shift towards a bullish trend could be on the horizon.

To effectively trade a Dragonfly Doji, one must look for confirmation. A single Dragonfly Doji may not be enough to confirm a trend reversal. Look for other technical indicators or patterns that support the reversal.

Wait for the next candle to validate the Dragonfly Doji, and wait for it to close. If it opens higher and continues to rise, it strengthens the bullish reversal signal. At this point, one may set Stop-Loss and Take-Profit Levels. This helps to manage the risk. One must set stop-loss orders to limit potential losses and take-profit levels to lock in profits.

Example of a Dragonfly Doji Reversal

Let’s consider a real-world example to illustrate the power of a reversal Dragonfly Doji candlestick in signaling a trend reversal. Imagine you are monitoring the price chart of a stock that has been in a prolonged downtrend. The stock’s price has steadily declined for several weeks, and you are considering whether to enter a long position.

Suddenly, you spot a Dragonfly Doji candlestick forming at the end of the downtrend. This is a potential reversal signal. You decide to wait for confirmation.

The next day, the stock’s price opens higher than the Dragonfly Doji’s closing price and continues to climb throughout the trading session. This is a strong confirmation of the reversal signal.

You enter a long position, and over the next few days, the stock’s price continues to rise, resulting in a profitable trade. This example highlights how the Dragonfly Doji can be a valuable tool in identifying trend reversals and making informed trading decisions.

Note! Always confirm the trend through other technical indicators before making a final trade decision.

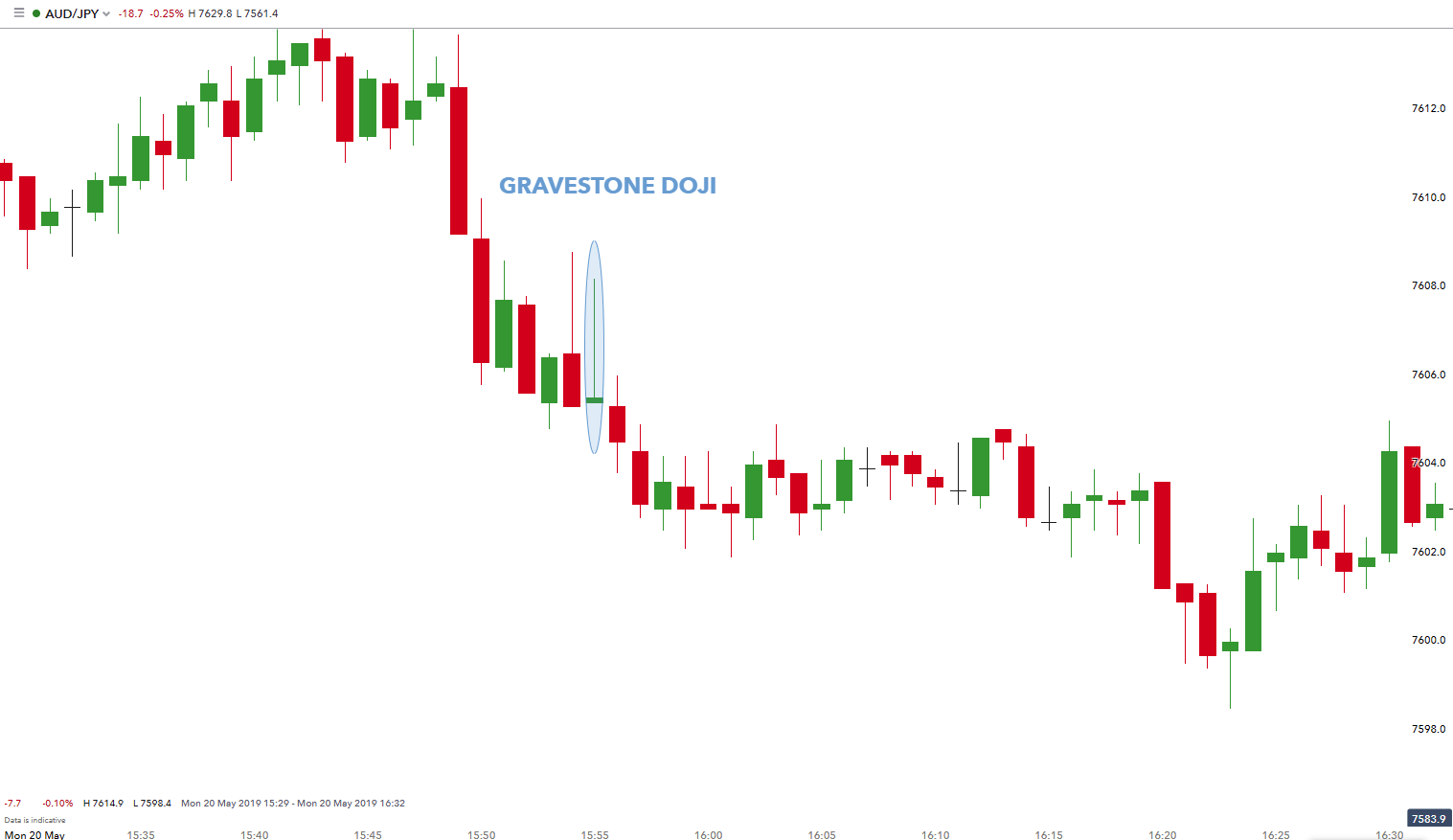

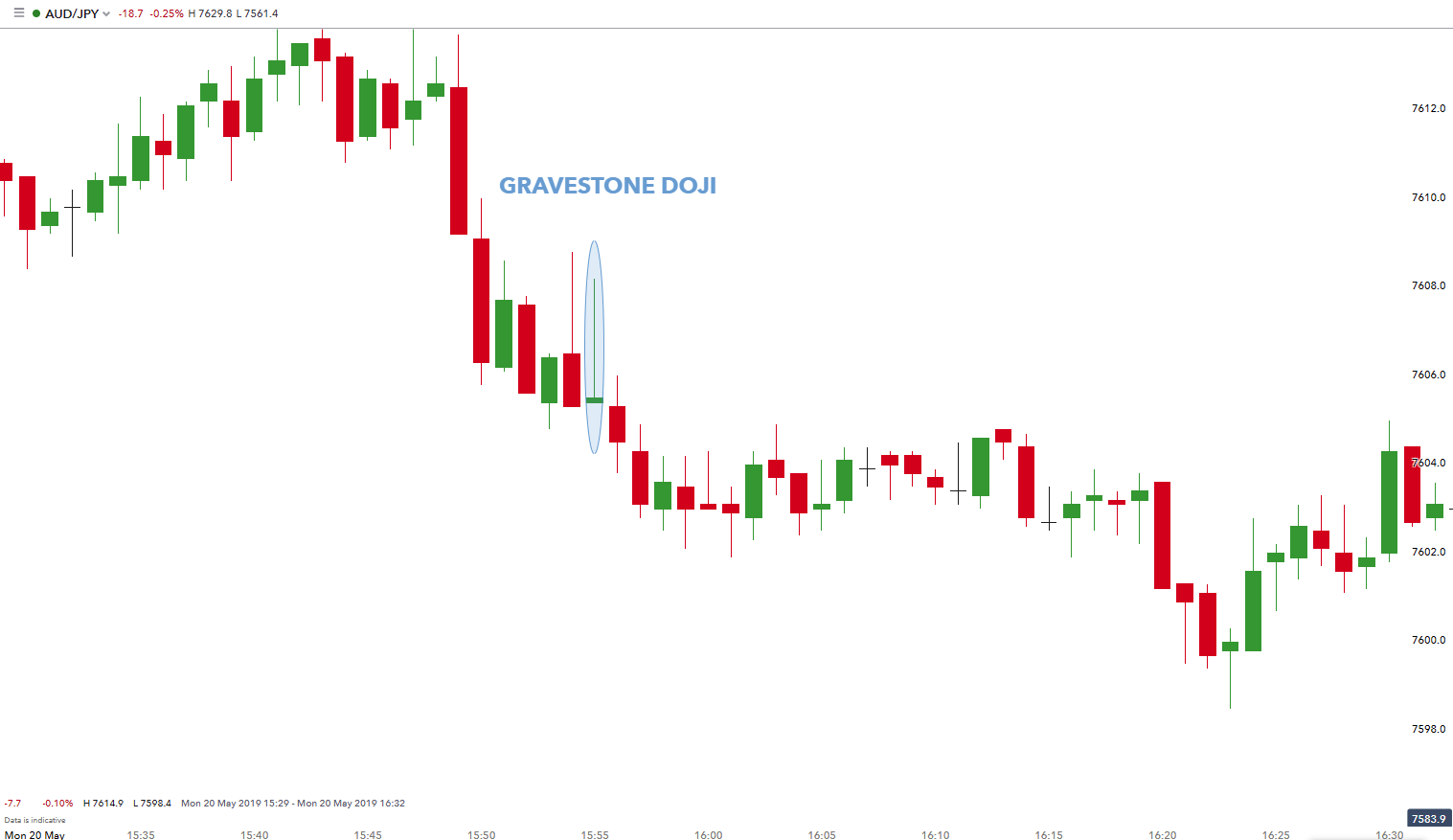

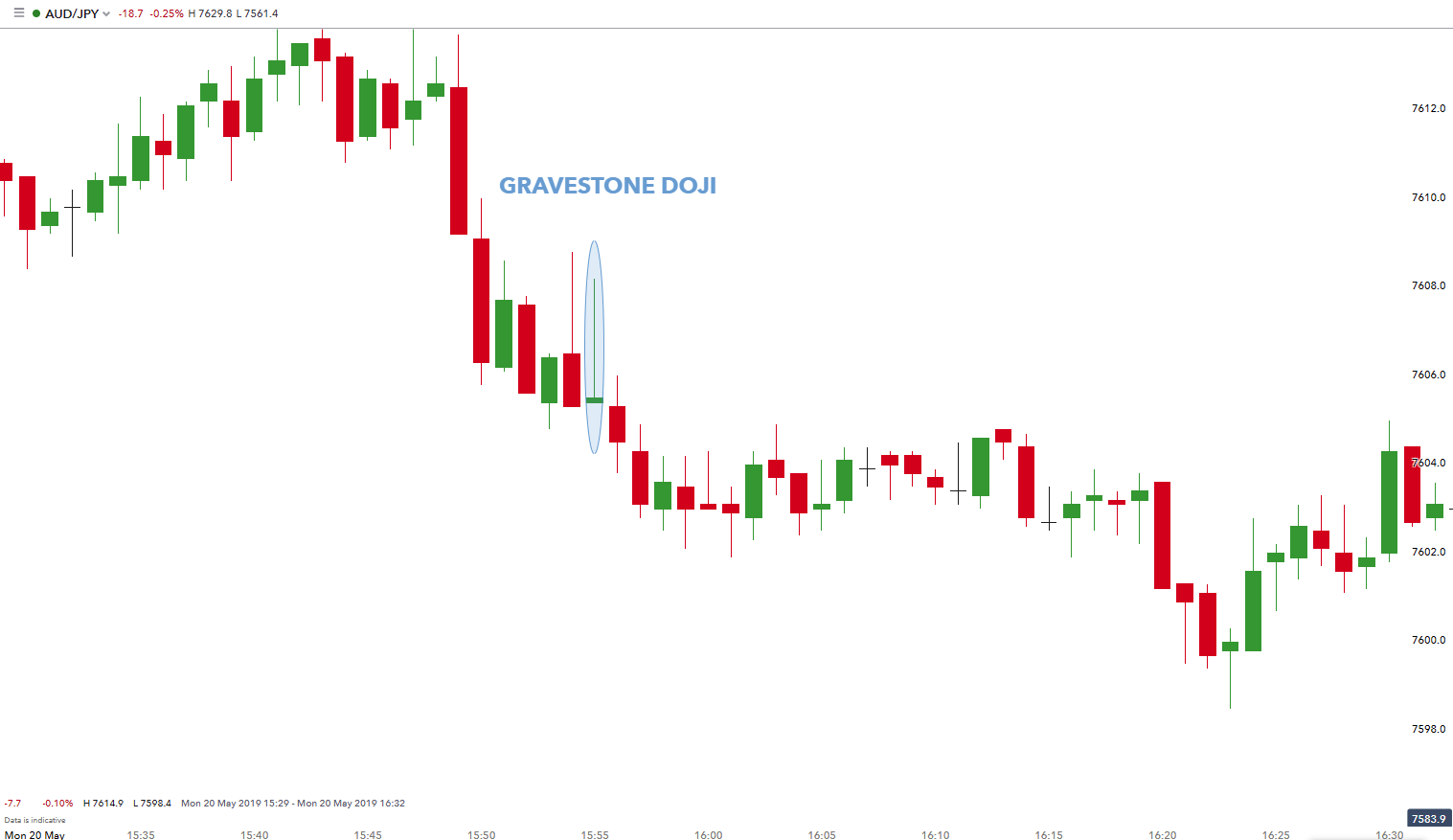

The Gravestone Doji: Definition and How to Trade It

The Gravestone Doji candlestick is actually the mirror image of the Dragonfly Doji. You can see a clear difference between the two images given above. Unlike Dragonfly Doji, Gravestone Doji has a small body with a long upper shadow, resembling a gravestone. It is the polar opposite of the Dragonfly Doji regarding its shape and implications.

This pattern typically appears after an uptrend and signals a potential reversal to the downside. It suggests that despite the bullish pressure, sellers managed to push the price back down by the end of the trading session.

Gravestone Doji patterns can be powerful reversal signals, indicating a shift in market sentiment from bullish to bearish. The Gravestone Doji is another essential Doji candlestick variation that traders must be familiar with.

The Gravestone Doji forms when the opening, closing, and highest price of a trading session are nearly identical, while the lowest price is significantly lower. Visually, it resembles an upside-down “T” or “cross”, with a long upper shadow and little to no lower shadow.

How to Trade a Gravestone Doji Candlestick

A Gravestone Doji indicates a potential bearish reversal in the market. It suggests that the market may lose its bullish momentum after an uptrend, and a shift toward a bearish trend could be imminent.

To effectively trade a Gravestone Doji, one must seek confirmation, as discussed above in the Dragonfly Doji.

Wait till the next candle strengthens the bearish reversal signal, and wait for the next candle to close. If it opens lower and continues to decline, it supports the reversal. At this point, manage your risk by setting stop-loss orders and take-profit levels to protect your capital.

FAQs: Common Questions About Doji Candlesticks

Now that we’ve covered the basics of Doji candlesticks and their variations let’s address some common questions that traders often have about these important reversal patterns.

Q1: How reliable are Doji candlestick patterns?

Doji candlestick patterns are highly regarded for their reliability, especially when they appear after a significant trend. However, they should be used in conjunction with other technical indicators and analyses to confirm potential reversals.

Q2: Can Doji candlesticks appear in any time frame?

Yes, Doji candlesticks can appear in various time frames, from minute charts to monthly charts. The significance of a Doji may vary depending on the time frame, so it’s essential to consider the broader context.

Q3: Are Doji candlesticks suitable for day trading?

Doji candlesticks can be used in day trading, but they are more effective in swing trading or long-term analysis, where they signal potential trend reversals over a few days or weeks. Long-term analysis enables the traders to validate the effectiveness of signals generated by Doji.

Q4: Can Doji patterns help with risk management?

Absolutely, Doji candlesticks can assist in setting stop-loss levels and identifying potential entry and exit points. They provide valuable information about the market sentiment and potential price direction.

Q5: Are there other Doji variations besides Dragonfly and Gravestone?

Yes, there are several other Doji variations, each with its own unique characteristics and implications. Some examples include the Long-Legged Doji, Rickshaw Man Doji, and Four-Price Doji. Traders should familiarize themselves with these variations to enhance their technical analysis skills.

Q6: How can I practice identifying and trading Doji candlesticks?

Practicing on a demo trading platform is an excellent way to hone your skills in identifying and trading Doji candlesticks. Many online brokers offer demo accounts where you can trade with virtual money, allowing you to gain experience without risking real capital.

Conclusion

In conclusion, it can be said that Doji candlesticks are essential tools in every trader’s arsenal. It does not matter if you are a beginner or an experienced trader, understanding the nuances of Dragonfly and Gravestone Doji candlesticks can significantly enhance your ability to identify trend reversals and make more informed trading decisions.

However, it would be prudent to highlight here that while Doji patterns such as the Dragonfly Doji and Gravestone Doji are powerful, they should be used in conjunction with other analysis techniques to maximize their effectiveness in the dynamic world of financial markets. By incorporating these patterns into your trading strategy and practicing diligent risk management, you can enhance your ability to navigate the dynamic world of financial markets.