The term “Gamma Hedging,” as used in trading, refers to the strategy deployed by traders to strike out the risk associated with the instant price movement of the underlying asset. Aggressive changes in price are often experienced towards the expiration date of an asset.

An underlying asset undergoes rigorous movements a few days before the expiration date. This fluctuation in price can either go as speculated or the other way around. Gamma hedging ensures that option buyers find a rescue strategy from any market emergency.

Primarily, gamma hedging helps to handle an asset’s imminent aggressive price movement. More precisely, this trading strategy can take care of huge price movements efficiently and is often perceived as a worthy alternative to delta hedging. For option buyers, gamma hedging is a strong line of defense against inconsistent price trends.

What is Gamma Hedging?

Gamma hedging is a strategy that deals with eliminating the risks caused by aggressive and sudden underlying security movements. These sudden changes are very common, especially a couple of days before the securities expire.

Often, on the very last day, those underlying stocks will go through quite some aggressive movements. How they affect the trader will depend on how they move. They could be in favor of the buyers, or they could be against them. As a result, they can be either profitable or may put the option buyer at risk of loss.

Gamma hedging kicks in as part of a sophisticated yet essential risk mitigation plan. Its purpose is to help option buyers in the event of an emergency. It uses handles to control rapid price movements that frequently occur on the expiration date. No matter if it is a small movement or a big one, Gamma hedging can handle it, seemingly without effort.

Gamma Hedging vs. Delta Hedging

Gamma hedging and Delta hedging are quite similar – to the point that Gamma hedging is used as an alternative to its Delta counterpart. That being said, while both can help you mitigate the risk, there are a few differences between the two.

Delta tells you exactly how much the price of an option is expected to change within an underlying asset of stock. This one tracks one-dollar price changes, meaning that you will be notified even with the smallest of shifts. It tells you an average, using currencies to make a prediction.

On the other hand, Gamma uses percentages. It looks at the change rate of Delta in regard to the price changes of an asset or stock. It has the potential to track two-dollar moves, offering a slightly more accurate change rate of the asset prices as compared to Delta hedging.

How does gamma hedging work?

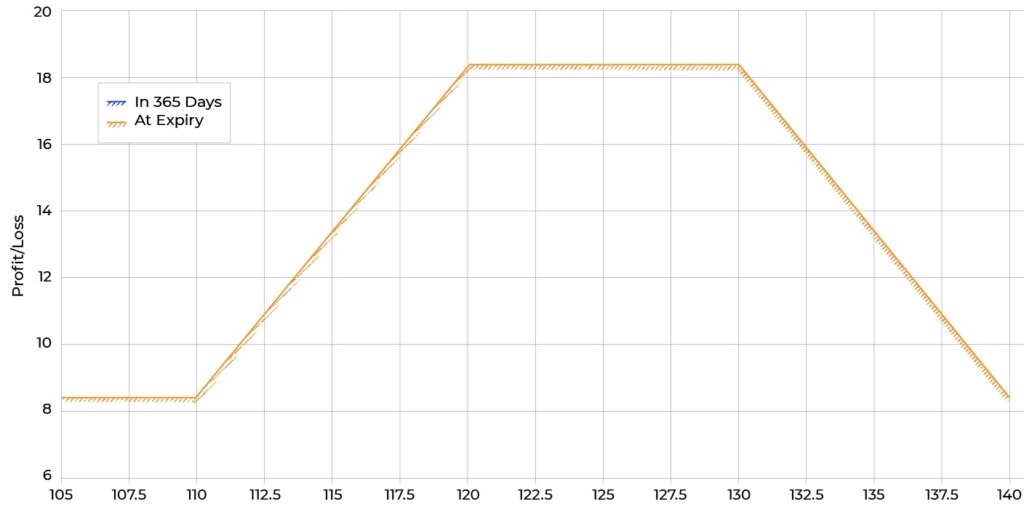

Investors and day traders rely on a gamma hedging strategy to help nullify the risk around their option purchase. This strategy works by adding new contracts to your current trading portfolio. Take, for instance, day traders who can decide to add option positions to their current portfolio if they suspect an extreme price movement is likely to take place within 24 to 48 hours.

With that said, gamma in itself is a standard variable, used often to price options. The whole process of gamma hedging happens to be complex, which implies how tricky it could be when calculating.

The gamma hedging formula consists of two variables. These variables allow an investor or trader to determine the movement of underlying assets. These variables help to reduce loss and accelerate profit.

Gamma hedging: an options risk-management tool

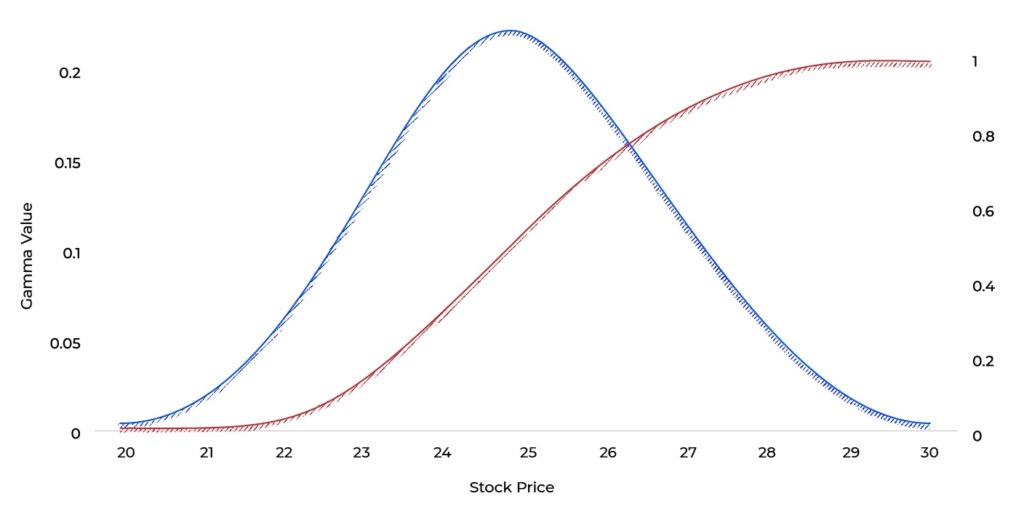

Gamma is a crucial tool for risk management. Before using gamma to gauge the risk attached to trading options, traders need to determine the stability of the delta. With gamma, investors and day traders can predict the value of the delta whenever the price of the underlying asset changes.

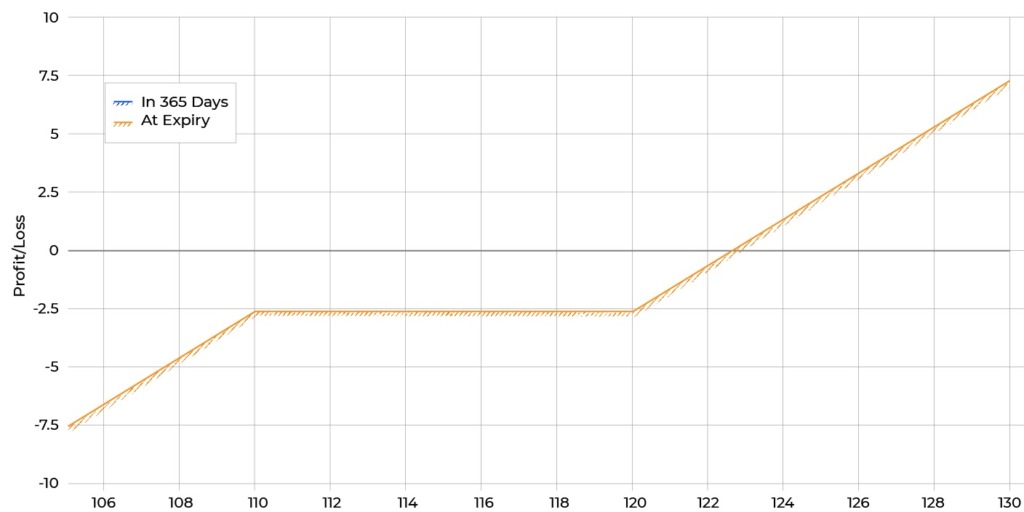

The hedging strategy does not only help traders to handle risks that concern option purchase, but it also assists in identifying which option has the most ability to offset losses in the current portfolio. The goal of gamma hedging is to maintain a delta that is constant all through the trader’s options and stock portfolio.

To have a balanced overall portfolio, investors and traders will purchase options that oppose the ones already in the current portfolio. For instance, a trader holding a handful of call options may purchase a few put options to hedge against a drop in the asset price.

How to calculate gamma

The calculation of gamma is in itself complex and will require sophisticated programs. Below is an example of how you can calculate the value of gamma.

Gamma = Difference in delta/change in underlying security’s price

Gamma = (D1 – D2) / (P1 – P2)

According to the above formula, D1anf D2 is the first and second delta, respectively, while P1 and P2 are the first and second price of the underlying asset, respectively.

Gamma Example

For instance, there is an option contract with a delta of 0.6 with a gamma of 10%. The underlying assets of that option will be trading at $10/share. If there is a 1 dollar increase in the stock price, the delta will increase to 0.7. Similarly, if the stock price drops by a dollar to $9, the delta will also be reduced to 0.5

This means that if the delta is 0.6 and a dollar increases the stock’s price, the option’s value will also increase by $0.60.

Conclusion

While gamma hedging remains a potent risk management trading strategy for all and sundry, it also holds some risks. Although options buyers benefit from this strategy for gain, the gamma rate can compound losses for options sellers.

When using the gamma hedging strategy, especially for options sellers, it is important to keep an eye out for the expiration date as there is a low probability that the asset will get to a strike price.