Extensive research evidence confirms a link between the World Cup event and market trends.

This global event celebrates soccer but exerts a noticeable influence on the economic dynamics of the participating countries. Let’s take a short walk through history.

2006, 2010, 2014 & 2018 WORLD CUP: market reactions and analysis

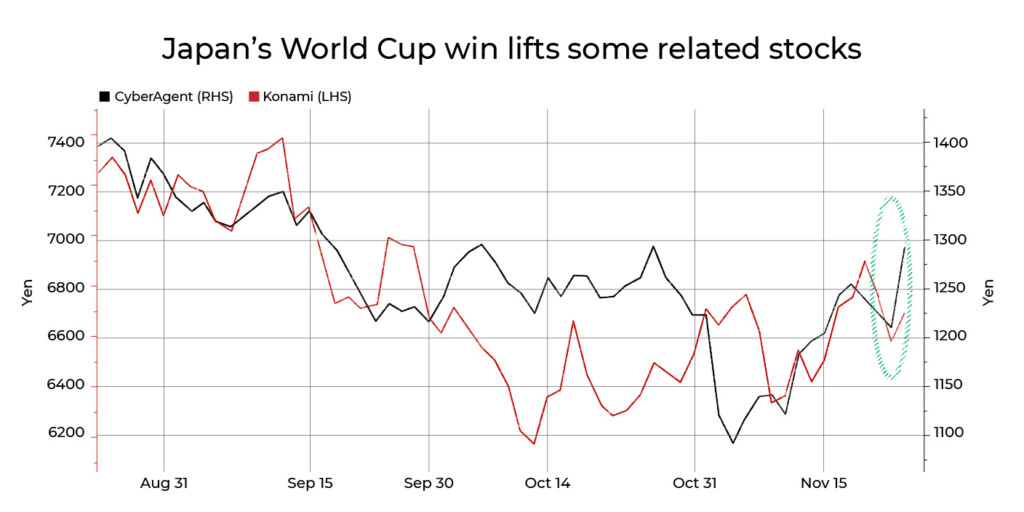

The World Cup Effect is a widespread phenomenon that illustrates the influence of this sporting event on market trends. As the market is heavily influenced by emotions or psychology, hosting the world cup, scoring goals, or emerging as winning champions are striking occurrences expected to significantly impact the market and influence investors around the globe.

2006, 2010, 2014, and 2018 world cup events were hosted by Germany, South Africa, Brazil, and Russia, respectively. Based on market analysis, in the 20 days before the announcement of the world cup hosts, Germany’s and South Africa’s major markets experienced a decline in Cumulative Average Abnormal Return (CAAR). In contrast, South African markets experienced a positive upward trend in the 20 days post-announcement, while Germany experienced a gain in over five days post-announcement.

Market analysis of positive changes in trends following host announcements indicates that investors treat this as good news. Following the announcement that Qatar will be hosting the 2022 world cup, its share prices rose to the highest it experienced in 2 years. The Qatar Exchange Index was reported to have increased over 7% at market opening, then closed at about 4% up.

The World Cup and its market-inclined trend

Experts argue that the major influence of world cup activities on the market is strongly tied to sentiments. The most striking observation about these market trends is that they’re as short-lived as the emotions behind them. Through the years, some of the commonly seen market trends include:

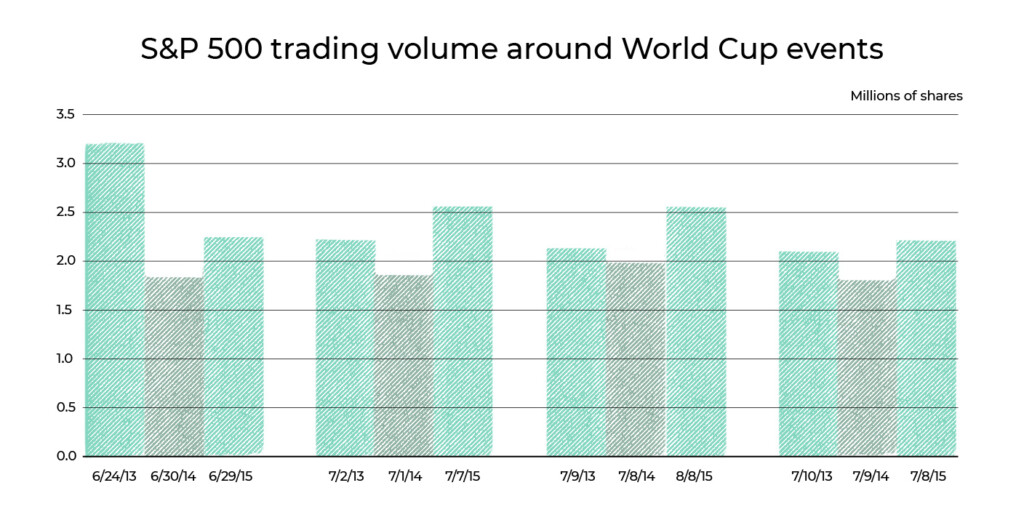

1. The trading holiday sequence

Research shows that trading volumes fall during matches, noticeable with trading activity in the host country when the team plays during trading hours. Traders tend to pay less attention to the market and respond poorly to relevant news when a game is ongoing.

During the 2010 world cup, an analysis of trading activity from markets of 15 countries by European Central Bank Scholars revealed a 45% drop in the number of trades and a 55% fall in trading volume, which dipped even further when a goal was scored. In Brazil, a 75% drop was recorded when the national team played, and in Chile, let’s say trading was placed on a soft pause.

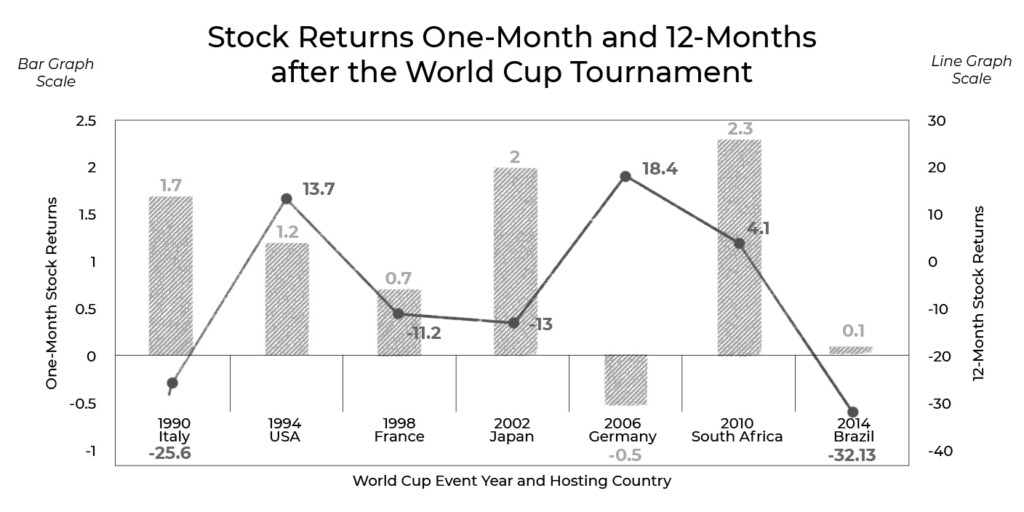

2. The champions take 75% of the market back home

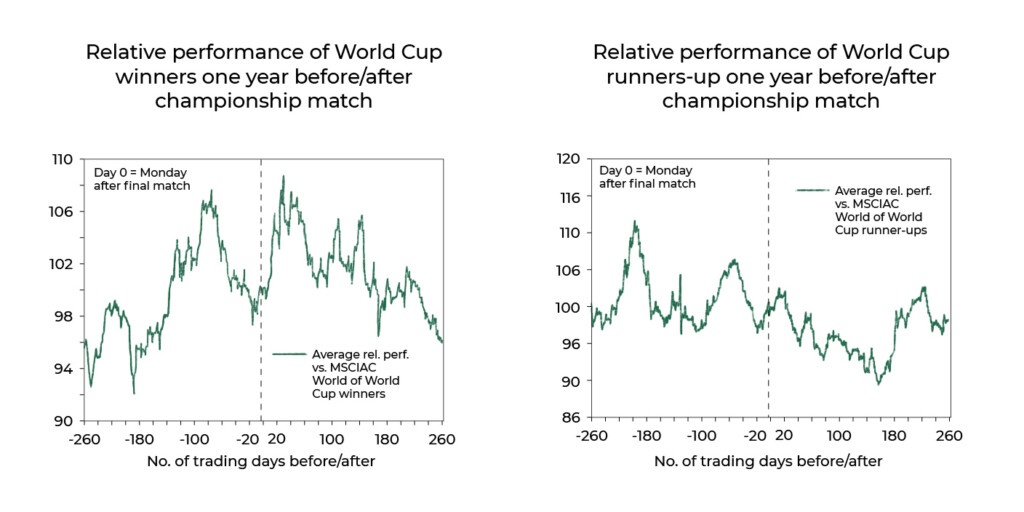

According to a Goldman Sachs report, the winners experience a short-lived boost in the market over the next few months. This has stayed the same with every world cup except for Brazil’s win in 2002, where the market remained a home of woes.

Most experts link this phenomenon to traders’ sentiments, as a win is expected to increase trading volume and the demand. Most winning countries experience positive upward trends for a few months, which eventually fall back significantly quickly. Investors may want to take advantage of these possibilities.

3. Runner-ups lose the market to a large extent

In the same way, the champions experience a boom in the global market. Losing countries are expected to experience equally short-lived downward plunges in the markets. According to Goldman’s report, the last nine countries from the finals underperform in the market by 5.65 in the following months. This effect is short-lived and is attributed firmly to investors’ moods, especially in passionate countries.

Markets with the biggest hits—Investors watch

While experts agree that the outcome of world cup events influences traders across different financial markets, some of the main markets experienced noticeable changes in market trends. These include:

—The Betting market

—The beer market

—Tourism

—Real estate

—Transport

—Sports apparels

—E-commerce

—Online viewing applications

—Social media networks/apps

With millions of viewers and fans traveling to host countries, engaging social media posts on the world cup tournament, purchasing jerseys and other sports apparel, and accessing viewing sites for match highlights or live streams, investors should expect a boost in these sectors in the months leading up to the event and for months after the event. The real estate in Dubai is currently at an all-time high and promises to stay on a positive upward trend when the tournament ends.

General recommendations for traders and investors

1. Stay aware of your emotions: this will apply to every period and market change. Getting a good grip on your emotions is essential for making sound judgments and avoiding market traps.

2. Strategize effectively: During the world cup, investors who have studied market trends can devise intelligent moves to maximize the limited opportunities created by trends in various sectors.

3. Remember to underestimate basic skills: As an investor, you are committed to identifying potentially profitable ventures and investing right. Essential skills include: gathering basic knowledge, sharpening your decision-making skills, and conducting proper research.