EQ is more important than IQ. Research carried out by the Carnegie Institute of Technology shows that 85% of your financial success depends on your personality and ability to communicate. Technical knowledge is responsible for the other 15%. So, your emotional wellness can make or break your career.

Putting your money in ever-changing markets can bring up a lot of emotions. From the thrill and euphoria of the highs to the panic and disappointment that accompany the lows. Some people find it easier to ignore emotional pulls and make thoughtful decisions. But for most traders, it takes effort to stay in control of their emotions through all the ups and downs.

Here is how to protect yourself against your own worst instincts.

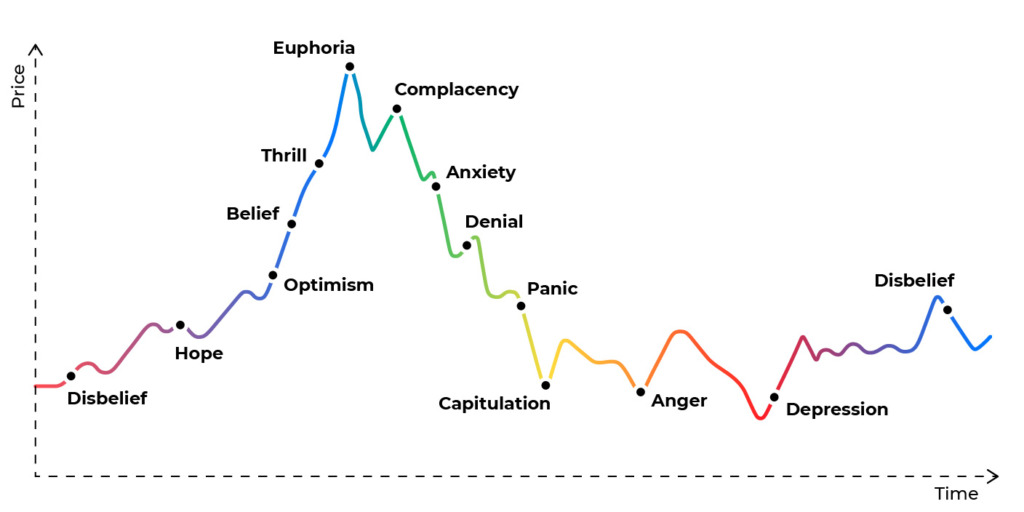

Emotional cycles in trading

Erratic price action can put you through a lot. Suppose the asset price was in a strong uptrend, plummeted, and is beginning a slow recovery. Here is what you may feel:

- Disbelief: You’re worried the uptrend will fail.

- Hope: You start to think the uptrend will hold.

- Optimism: You become more confident in the price action.

- Belief: You have strong faith in the uptrend.

- Thrill: You see some profits.

- Euphoria: You think nothing can go wrong.

- Complacency: You don’t take the pullback seriously.

- Anxiety: You start to worry.

- Denial: You think the market will reverse.

- Panic: You see your account going down and lose your cool.

- Capitulation: You exit your positions.

- Anger: You’re mad at yourself and the market.

- Depression: You feel negative and hopeless.

- Disbelief: You don’t take the first rallies into a bull market seriously.

As you can see, even a couple of market moves can take you on an emotional rollercoaster.

The importance of controlling emotions while trading

If you let your emotions guide your trading decisions, you’ll be exposing yourself to unnecessary risk. Trading is risky as is, so you don’t want to elevate it manifold.

When traders are emotional, they tend to ignore the fundamental aspects of their strategy. If your assets are experiencing an exhilarating bull run, you might start increasing the size of your trades. If you feel nervous and anxious about a losing trade, you’ll sell your assets without letting them recover.

Any kind of strong emotion can make you aloof towards the bigger picture, which is detrimental to prosperity building.

Ways to control emotions: 5 tips

These 5 tips will help you make moves that aren’t fueled by your emotions.

1. Establish your own rules

Don’t open your trading terminal and asset charts without a plan. It’s important to follow a system that dictates what to do in different market situations. Even a basic set of rules that you create for yourself can prevent significant mistakes.

2. Be prepared for the market collapse

When something goes wrong on the market, it triggers only one thought in traders’ minds—how much value they are losing. At moments like these, you sometimes need to react quickly. Think of it as an emergency management strategic plan.

3. Ignore the market noise

Most market noises are inconsequential, considering most people take volatility as serious news. It helps to have an overall understanding of existing and forming trends. But focusing solely on what you hear from others will subsequently lead to overreaction and steer your trades.

4. Consume your media in a healthy way

Don’t take investment or trading advice from social media. A good portion of beginner traders gets their news, price updates, and analyses from bloggers. Keep scrolling and reading if you want, but don’t let others control your finances.

5. Think long term

Acknowledge that any market situation, whether good or bad, is temporary. Trust your strategy to take your portfolio through the ups and downs. Your asset value won’t stay the same, but what matters is long-term performance.

You can’t and shouldn’t turn off your emotions completely. But for your own sake, you should separate your decisions from your emotions.