If you are an experienced trader, you know that trading signals are confirmed not only by indicators and chart patterns but also by analysis of several timeframes. Day trading has its unique features. For example, in India, intraday stock trading is an additional option that should be chosen by a trader on the trading platform. Day trading occurs within a day so that if a trader doesn’t close a position until the trading day ends, the position will be closed automatically.

What charts should you compare when trading intraday? What are other unique features of trading within a day? Read on to answer these questions.

What are timeframes, and what intervals to combine?

Every advanced trading platform provides a wide range of timeframes, including one second and one month. A timeframe is a period during which a new price bar is formed. For instance, if you trade on a daily chart, it will be formed every trading day and include open, close, high, and low prices for the day.

The timeframe determines the time interval you will more likely be in a trade. If you find a pattern or indicator signal on a 5-minute chart, it will work out within one hour. However, a pattern on the daily chart can be formed and executed within several days or even weeks.

Multiple timeframe analysis is a process when a trader considers price movements of the same asset for various time periods.

Upon examining several charts, you receive a confirmation of the major trend. Therefore, you are sure you aren’t trading against the market and can confirm the signal or pattern on the timeframe you trade. Below, you will find the reasons why it’s important to examine several timeframes for one trade.

What timeframes to choose for trading

Before you start combining timeframes, you should determine which one will be your basic timeframe. This choice will depend on your trading strategy and style. Define:

- The amount of time you can spend on trading per day

- The most popular timeframes for identifying trade patterns and signals

If you don’t have much time to spend on market analysis, you can consider a 4-hour chart for entry points and a daily chart for overall price analysis. If you have more time to spend within a day, you can consider lower timeframes as they require more time to react fast to quick price changes.

Below, you can find a table with the most common trading styles and timeframes.

| Strategy | How long to keep a trade | Overall trend | Entry points |

| Swing-trader | From a few hours to a few days | Daily | 4-hour |

| Short-term | Less than a day | 4-hour | Hourly |

| Scalper | Less than a few hours | Hourly | 15-minute |

Confirm setups

There are two basic approaches to confirming a setup.

- Three consecutive timeframes

There is a common rule that you should find confirmations of the setup you are going to trade on smaller and bigger timeframes. For instance, if there is a pattern on the daily chart, you should analyze 4-hour and weekly charts. If there is a signal on the future price direction on the 30-minute chart, you can look for confirmation on 15-minute and hourly charts.

It’s important to be sure that signals on other timeframes do not contradict your conclusions about the upcoming price directions.

Let’s consider an example.

On the daily chart of PEP stocks, there is a hammer pattern that signals an upward price movement. However, technical indicators don’t provide certainty on the upcoming price direction.

On the 4-hour chart, the price has formed a Doji candlestick that signals market uncertainties. However, the Relative Strength Indicator may break above the RSI-based MA soon. This would confirm the price rise.

On the weekly chart, there is a candlestick with a long upper shadow that signals the bulls’ weakness.

Summing up signals on three charts, you can conclude that it’s unlikely the hammer pattern on the daily chart will work. Therefore, you should not open a new trade.

*You can use timeframes with a bigger interval difference. However, it’s not recommended to confirm signals on minute timeframes by analyzing weekly and monthly charts.

- 1:4 or 1:6 ratio

There is one more approach: to use the 1:4 or 1:6 ratio. It allows a trader to uncover smaller price movements to enter the market on good levels. For example, if you trade on an hourly chart, you can consider the overall trend on 10-minute or 15-minute timeframes. Signals on shorter timeframes may provide effective entry points, while the hourly chart is where the opened position will progress.

However, when using this approach, you shouldn’t focus on extremely low timeframes. It’s a well-known fact that short-term price movements have a limited impact on the overall trade. Moreover, the price changes too fast, leading to unnecessary stress, especially for a newbie trader. Small timeframes should be used only to determine well-timed entries based on small price movements.

Don’t dwell

Sometimes, you miss potentially successful trades only because you don’t want to assume that your prediction is wrong. Imagine you believe the price will rise on the 30-minute chart. But the market is moving in the opposite direction. You keep looking for patterns and signals, expecting the price to reverse.

However, if you switch to another timeframe, you can find a more reliable signal that will provide a good entry point. Change periods during the trading day, and you will find many opportunities.

Longer trades

You need to make multiple trades on intraday timeframes to gain significant rewards. Scalpers can open up to 100 trades within a trading day to receive considerable returns. Therefore, longer trades are considered more profitable. However, you should remember the risks they bear. Higher returns increase risks simultaneously.

The success of longer-term trades lies not in the amount of time you keep the position open but in your ability to enter the market at the beginning of the trend.

Shorter-term timeframes can help you do that. A breakout on a 30-minute timeframe may be the beginning of a breakout on an hourly chart. This may be the beginning of the breakout on the daily chart. As a result, you can enter the market much earlier than any other trader who looks for a breakout signal on the daily chart. Also, rewards from the breakout on the daily chart will exceed those on the 30-minute one.

Strong support and resistance levels

Support and resistance levels are key elements of any trade. Knowing these boundaries, you can easily identify entry and exit points. However, the levels that seem important in one timeframe are useless in another.

Let’s imagine you found a strong support level on the 30-minute chart. Now, you can define whether this level is important for longer-term trades, or you can use it only to trade on a short-term period.

Support and resistance levels are vital as they serve as boundaries that prevent price movements. When the price touches a support level, it turns up; while approaching a resistance level, it turns down.

You shouldn’t expect that a support level on a 5-minute chart will have the same strength as on the weekly chart. However, support and resistance levels on periods with a narrow difference can affect each other.

Above, there is a 30-minute chart of PepsiCo’s stocks. As you can see, there is a strong support level that was in place for four days.

This level didn’t have an impact on the price movements on the daily chart.

A real example of day trading

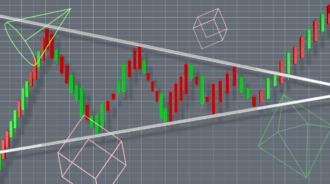

Intraday traders apply short-term timeframes to analyze market conditions. They usually use time periods from 1-minute to 1-hour. You can consider an example where a trader looks for entry points on a 15-minute chart and analyzes the overall trend on the hourly timeframe.

A day trader sees the price falls below the 50-hour simple moving average. It’s a sign of a downward trend. Thus, they can open a short position. After, the trader can open a 15-minute chart to find a well-timed entry point.

The price is moving within the contracting Bollinger Bands indicator. This is a sign of an upcoming increase in volatility. The trader should open a sell position when the price falls below the moving average and touches the lower band.

Trading example

For example, someone who wishes to make a change in their life may decide on trading forex. After doing some research, they decide that the best trading pair is the EUR/USD one and choose the 1-hour chart in favor of the 15-minute and 4-hour charts. The former is too fast, whereas the other takes too long.

Out of curiosity, the trader may look up at the 4-hour chart and see the overall trend. From what the charts look like, it seems to be going uptrend. This tells you that your focus should be on the BUY signal.

Going back to the preferred 1-hour chart – this one goes down and straight into oversold. However, our trader is not sure about the time frame, so they check the 15-minute one as well. That is when they see oversold conditions in that time frame. At that point, they conclude that it is a good time to buy.

Eventually, the trend continued, and the EUR/USD pair rose higher in the charts. Had our trader kept it open, they would have made even more pips. This is why it is recommended to use 2-3 time frames at most, so you don’t get confused by the multiple charts.

Final thoughts

Analysis of multiple timeframes is an effective technique that allows you to find well-timed entry points, determine strong support and resistance levels, confirm indicator and pattern signals, and broaden your trading horizons.