One of the key goals of a trader is to enter the market on time. According to statistics, only 4% of people manage to make trading their primary source of income. You need to learn a lot to be part of this 4%. It’s not difficult to enter the market, but it takes practice—and there are some secrets that will improve your entry strategies. Keep reading to learn them.

1. Pending orders

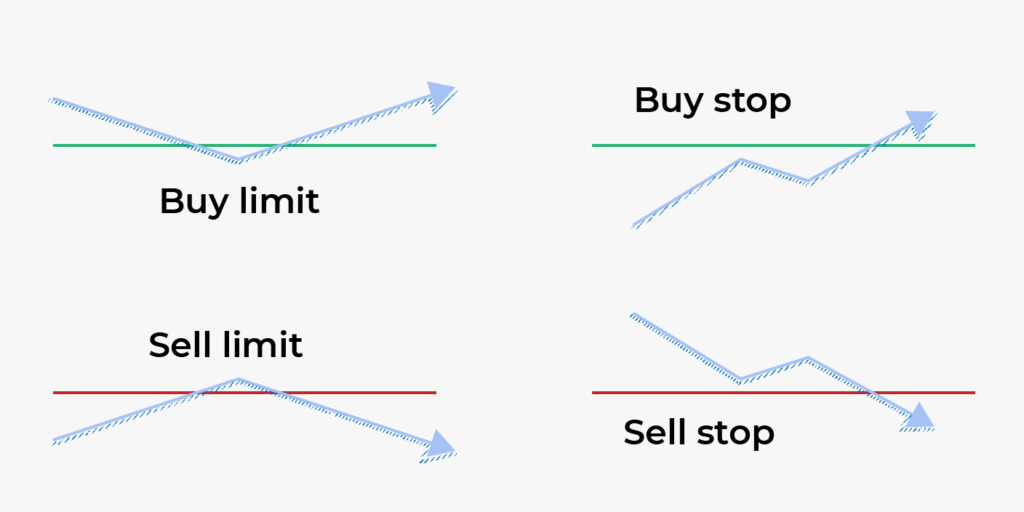

Pending orders allow you to evaluate market conditions without a hurry. There are four types of pending orders:

- A buy-limit order occurs when a trader waits for a price to rebound from a certain level. The price is falling, but strong support or a psychological level is expected to stop the decline.

- A sell-limit order is placed when a trader is sure an upward movement will end when the price touches a certain level. After, it will turn around and start falling.

- A buy-stop order is placed when a trader believes that if the price breaks above a certain level, it will continue rising. It can be a strong resistance or a psychological level.

- A sell-stop order is set when a trader believes that a breakout of a certain level will allow the price to keep falling. This order is the opposite of the buy stop.

2. Chart patterns

The easiest way to identify an entry point is to use chart patterns. Unfortunately, they don’t often occur, as it takes time for them to form. However, if you find one, there is a high chance it will work. Every pattern has its own rules. Therefore, you need to learn what they look like and how they work. There are a few most popular patterns, so you won’t have to spend much time learning them.

However, you should remember that a breakout of the key boundary doesn’t immediately confirm the price direction. Wait for the breakout candlestick to close.

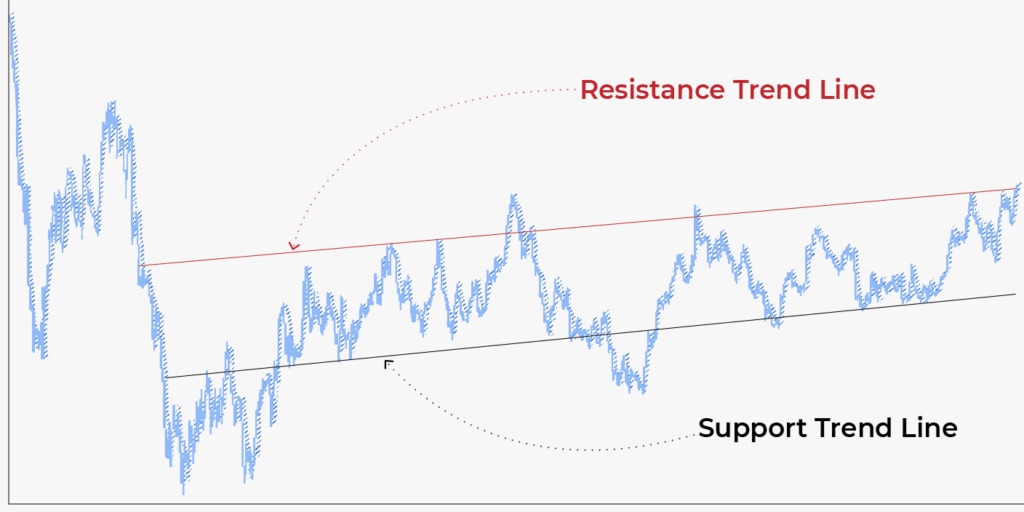

3. Trendlines

Trendlines are used to shape the current trend. When the price moves within a framed channel, it’s much easier to determine levels of a potential rebound. Trendlines serve as support and resistance targets. When the price comes to the upper boundary of the trend channel, you can expect it to fall. Therefore, you open a sell trade after it rebounds. If the price is near the channel’s lower boundary, you should be ready to open a buy position after the price turns around.

There can be a breakout and a fakeout. So, you need to wait for the price to rebound from the level.

4. Support and resistance levels

Support and resistance levels don’t just occur in trends. You can place them based on previous highs and lows. A level is considered strong if the price rebounded from it at least two times. Place the level based on the close prices of candlesticks where the price rebounded last time. Some newbies believe support and resistance targets should be placed based on candlestick shadows.

However, if buyers/sellers couldn’t drive the price last time, it’s unlikely they will succeed this time. It’s always better to enter the market a little bit earlier than to miss a trade.

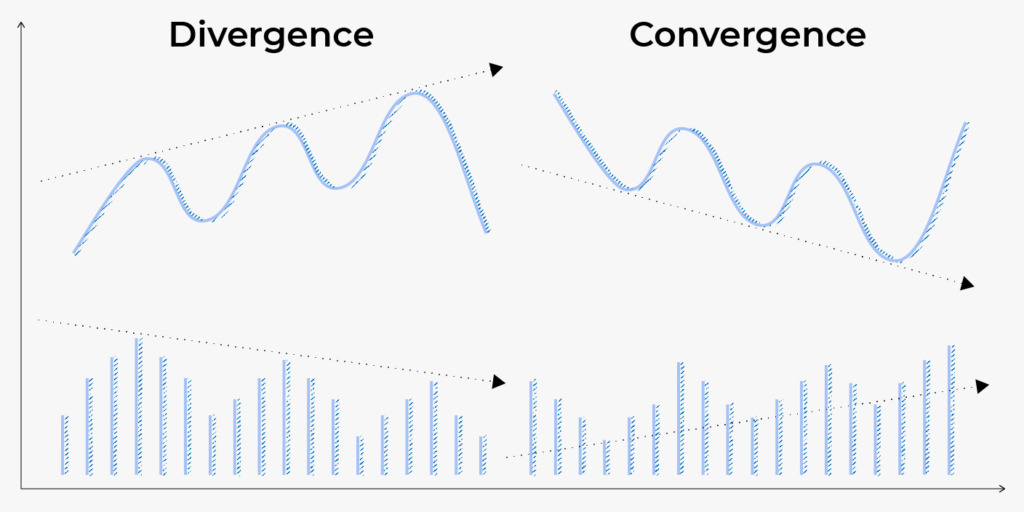

5. Indicator signals

Indicators signal the upcoming price direction but don’t show the exact level where you should enter the market. The convergence/divergence signal can be called the most reliable. If you find it on the price chart, you should be ready to enter the market. After the signal, wait for the price to break a strong support/resistance level and close beyond it. Afterward, you can enter the market in the breakout’s direction.

Final thoughts

An entry point is a vital part of successful trading. If you enter the market too early, you risk losing your funds because of the price reversal. If you open a trade too late, you risk losing the potential returns you could gain. Always practice before entering the real market.