There are tens (if not hundreds) of millions of traders in the world today and thousands of unique trading strategies—some of which offer better returns than others. But is there one best trading strategy? Let’s try to figure this out.

What is meant by trading in financial markets?

To begin with, it is worth clarifying that trading in financial markets is hard work and not only a profitable usage for one’s capital. A frivolous attitude to trading can cost a trader too much. Nial Fuller says: “Trade like a sniper, not a machine gunner.” Unlike an investor who seeks dividend income, a trader makes money by selling an asset at a higher cost than the purchase price.

A trading strategy is much like traffic rules: before you get profit, learn not to lose! The only problem is to determine with high accuracy which direction the price will go next. Some traders use technical indicators: moving averages, oscillators, and combinations of these tools. They help to filter out small “noise” on the price chart from large and stable movements.

What’s the advantage of a price action trading strategy?

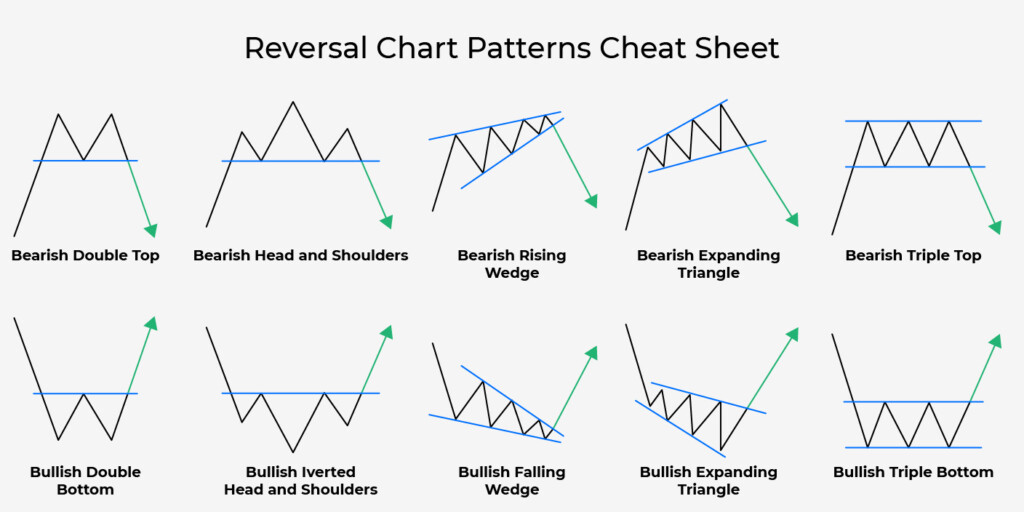

Unfortunately, most indicators are very late. They give signals to open or close a deal when the most favorable moment has already been missed. For this reason, many trading strategies have been created based on characteristic chart patterns.

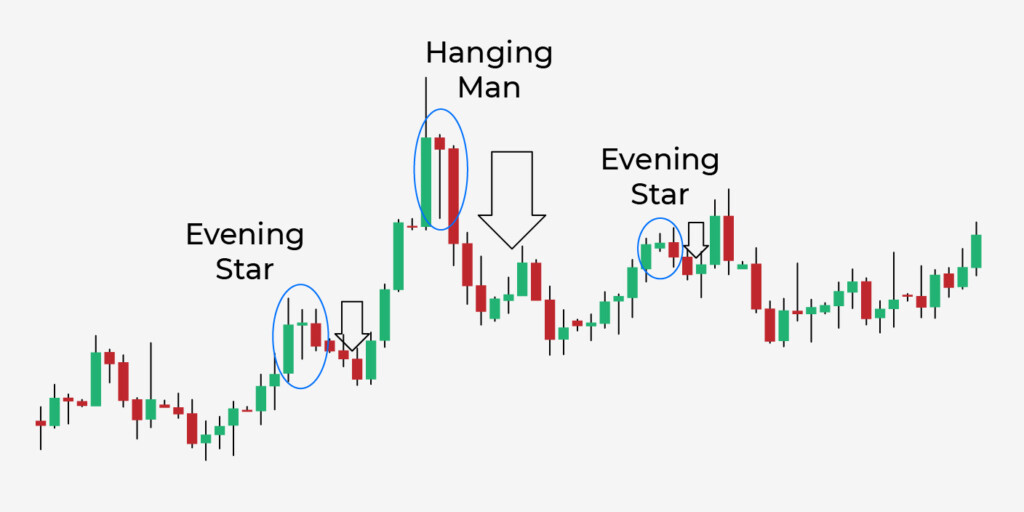

These include trend channels, triangles, flags, pennants, etc. There are continuation and reversal patterns. The generalized name of this group of strategies is price action. This figure shows an example of trend reversal patterns.

In addition to simple and popular graphic patterns used in medium-term (more than 1 day) trading, there are quite complex models. These include Gartley butterflies, Demark price projections, and the Elliot wave theory. These models do not have time to capture the initial stages of the formation of price patterns, since there are many chart-marking options. The closer the picture is to the completion of the pattern, the more accurate the forecast of further price movement will be. So, following a price action trading strategy requires patience.

What is the swing trading strategy?

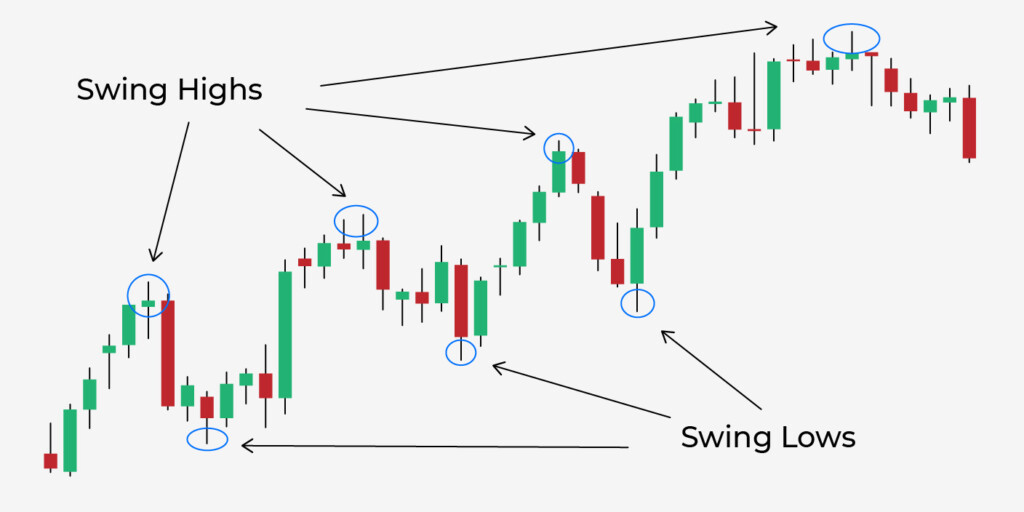

Along with price action strategies, there are options for more impatient traders. One example is the swing strategy. Strictly speaking, this is also a group of strategies united by a common principle – the trader is “swinging” on the upward and downward waves of price movements.

You can use different tricks to “catch” the trend reversal points. Japanese candlestick combinations are especially popular. They are interesting in that they allow you to enter a trade with the opening of a new candlestick, which follows immediately after the next combination occurs.

The scalping strategy – trading for risk-takers

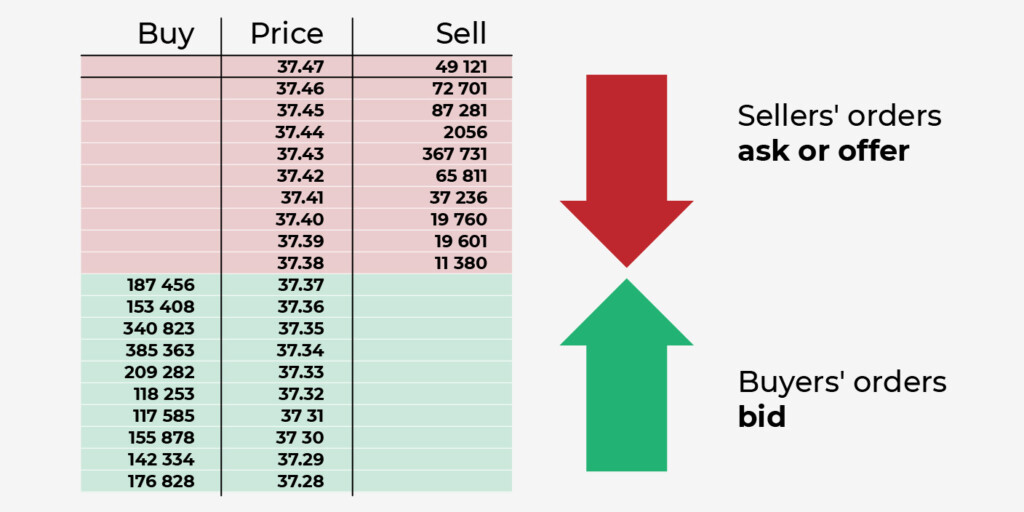

Finally, the most impatient traders will be interested in getting acquainted with the scalping trading strategy. It can hardly be called a standalone strategy, for there are numerous variations of scalping. One of the most effective is trading inside the order book. This is a graphical representation of pending orders from sellers and buyers.

The lower the sell order is and the higher the buy order is, the sooner one of these orders will work. Modern exchange trading has already turned into a competition: who will manage to make more transactions during the day? Champion scalpers have time to buy and sell assets literally every second. That’s why a trader’s profits are sometimes comparable to a broker’s commissions.

Are there any tools to analyze your trading strategy?

Most brokers allow you to test a trading strategy on a demo account, but this requires a serious investment of time. As a compromise, there are software strategy testers that allow you to skip a trading strategy if it seems to be risky. A good strategy works both on historical data and on new prices.

Conclusion

So is there a better trading strategy? Perhaps you have already understood that each strategy is unique, thus meaning it’s better suited to the individual temperament of the trader. In this sense, that’s the best trading strategy.

Sources:

An Introduction to Price Action Trading Strategies, Investopedia

Trading strategies every trader should know, CMS Markets