Avoiding mistakes happens to be damaging to your learning. An fMRI-based study revealed that students who focused on monitoring their mistakes, rather than on getting the right answers, learn better over time. Such an approach positively affects brain activity and leads to higher efficiency in the end.

If you want to have a long, fruitful career in trading, you can’t turn a blind eye to mistakes, whether they’re your own or somebody else’s. Here’s some advice for you based on the experiences of other traders, both positive and negative.

Define success

Let’s say you read a story of a successful trader and feel inspired. But what exactly inspired you? Is it the impressive career, their lifestyle, or something else? You should be specific about what you want. For example, if you want to get successful like them, define “success” and put a number to it.

Being specific is the first step to setting SMART goals (specific, measurable, attainable, relevant, and time-bound). Of course, the more capital you earn, the better. But having a specific amount in mind will help you define your risk tolerance, set the pace, and plan your activities.

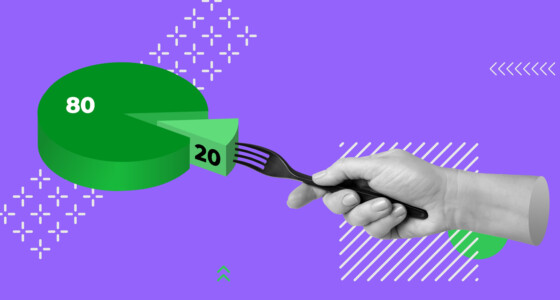

Plan the amount of capital you want to make according to the 50/30/20 rule — needs, wants, and savings, accordingly.

Learn the theory

As much as every skill is gained through practice and experience, first things first — trading demands knowledge. Whatever lessons other traders teach you, they need to be laid on top of a solid theoretical foundation.

Advanced traders have probably internalized the fundamentals and may not be consciously aware of them. Before you get to that level, you’re left to discover these basics on your own. The theory is critical, and if you notice it’s not discussed in detail in a certain strategy, it’s because it is assumed you already know it.

“I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced one kick 10,000 times.”

Bruce Lee

Start with common practices and strategies and then move on to more unorthodox methods to view trading from different perspectives.

Be independent

Being a retail trader gives you great independence and flexibility, but it also comes at a cost. When you become your own boss, you deal with high risk and increased responsibility. Do you feel ready to take on this role? How do you react to the increased burdens of keeping the business afloat? Do you have the motivation to work when there is no one to push you but yourself?

It’s also important to think about the future rather than about the immediate pleasures. For this, there are also a couple of things you should take care of.

Additional income

In addition to being an active trader, consider branching out into passive investments. What makes investing different from trading is that you don’t need to directly manage your assets on a regular basis. The ideal scenario is making capital without getting out of bed, just by having the right investments!

One way of making your investments work for you is through dividend stocks. Buy stocks of well-established companies that don’t reinvest as much capital as high-growth companies. These companies will make regular distributions to you, as one of the shareholders, so you’ll essentially be paid without doing anything.

Retirement plan

Only a handful of dedicated people choose to work forever. For most, the natural conclusion to a successful career is retiring and living a free, comfortable lifestyle.

Start preparing now so that you can have as much rest as you want when you’re older:

- Determine your time horizon (decide your retirement age).

- Calculate your retirement spending needs (the funds you need to have by the time you retire).

- Select your retirement investments, taking into account your goals and risk appetite.

- Calculate your return on investment (after-tax rate of return).

- Make sure you’re diversified and investing for growth.

Keep track of others (the right way)

It’s equally important to learn about success stories and failures. When you only read about traders who have built their legacies, you forget that most people don’t get as lucky. Besides, super-successful traders probably have more failures than you think. And they’ve probably lost more capital than an average person sees in a year. But they carried on!

Take your journey to capital one step at a time, and remember that it won’t be like anyone else’s. You’ll set the goals and pace at which you move towards them, creating your own unique path.