The word “market” is usually used to cover both primary and secondary markets. But these are not equivalent meanings. Let’s analyze what they are and why investors must distinguish between the primary market and the secondary market.

What is a primary market?

Let’s begin with the definition of the primary market. It’s the market in which firms float (introduce and sell) new bonds and stocks to the public for the first time, which is why the primary market is also known as the new issues market.

An Initial Public Offering (IPO) is an excellent example of a primary market. An IPO is an event in which a private company offers the public the opportunity to buy stock for the first time. Trades like this allow investors to purchase securities from the bank that completed the initial underwriting for the stock.

Let’s take the imaginary company, OEGIN Inc., as an example to understand the concept better. OEGIN Inc. is a company looking to launch an IPO. To do this, it hires five firms specializing in underwriting to calculate the financial details of its IPO. The hired underwriters conclude that the stock’s initial price will be $10. Investors can now buy a stake in the company at this price directly from the issuing company.

This is the first chance that investors get to purchase a share in the company through the purchase of its stock. The stock is bought directly from the company on the primary market, making it the main market through which the company accumulates its equity capital.

H2 – Types of the primary offering

Companies can raise additional equity via the primary market after their securities have entered the secondary market by using a rights offering (issue). A rights offering allows the company’s current shareholders to purchase prorated rights based on the shares they own, while others can invest anew in freshly created shares.

Other primary market offerings for stocks include preferential allotment and private placement. Preferential allotment offers shares to significant investors (usually hedge funds, mutual funds, and banks) at a price lower than that provided to the general public. On the other hand, private placement means companies can sell shares directly to significant investors (such as banks and hedge funds) without making the shares available to the general public.

Governments and businesses looking to generate debt capital can use a similar principle by issuing new short and long-term bonds on the primary market. The new bonds are issued with rates based on the current interest rates at the time they are issued, which may be lower or higher than pre-existing bonds.

What is a secondary market?

The secondary market is also known as the “stock market”. The Nasdaq, the New York Stock Exchange (NYSE), and most of the major exchanges you know around the world are examples of secondary markets.

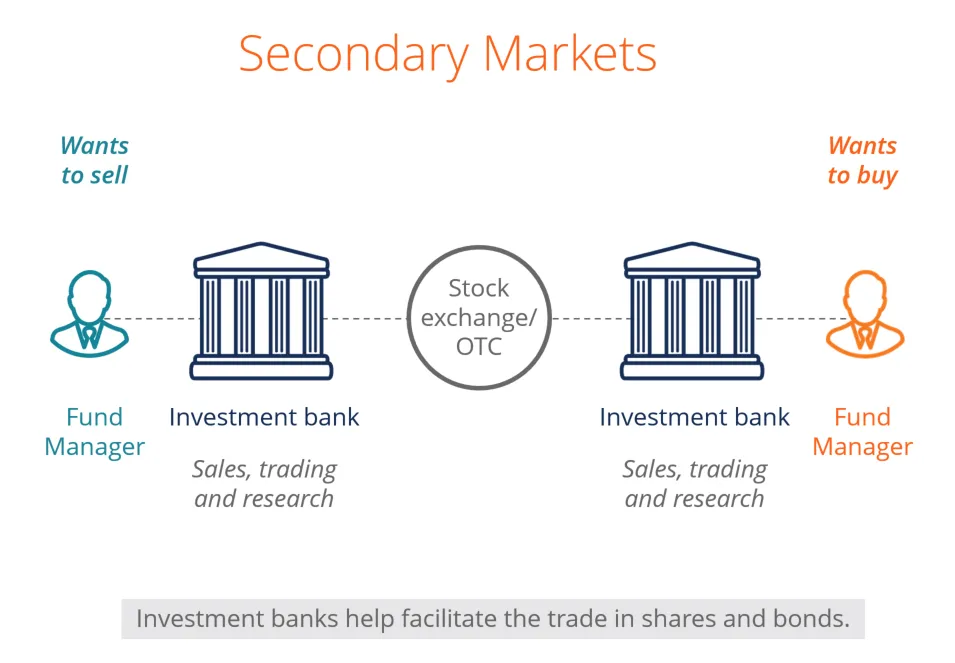

The main difference between primary and secondary markets is that investors in the secondary market trade among themselves. Meaning that secondary market users trade previously issued securities without the involvement of the issuing companies. For example, if you used the secondary market functions to purchase Amazon (AMZN) stock, you would be dealing with another investor who already owns shares in Amazon. Amazon itself would not play a part in the transaction.

As debt securities, bonds are guaranteed to pay their holder the initial investment plus a fixed interest rate at maturity. However, this date is often years away, and fluctuating interest rates mean that the current interest rates may fall after the bond issuance. The bond thus becomes more valuable to investors due to its relatively higher profit rate, which is why the bondholder can score a profit by selling these bonds on the secondary market.

Secondary markets can further be classified into auction and dealer markets.

Auction Markets

In an auction market, all individuals and institutional traders congregate in a single area, declare their bids, and ask prices. These are the prices at which they wish to buy and sell each stock. The New York Stock Exchange is a good example of an auction market.

By bringing together all parties and making them publicly announce their prices, auction markets make the trading process more streamlined and efficient. It removes the hassle of finding the best stock price because the convergence of buyers and sellers will bring about mutually agreeable prices.

Dealer Markets

Unlike auction markets, a dealer market does not require investors and sellers to come together. Instead, members of the market are joined through electronic networks. Dealers declare their inventory of security and then stand by to buy or sell with other market participants. These dealers profit from the difference between the prices at which they buy and sell assets.

The Nasdaq is an example of a dealer market in which the dealers, also known as market makers, declare the bid and ask prices at which they are looking to buy and sell a security. Theoretically, the competition between the dealers helps investors get the best possible prices.

Moving on, the so-called “third” and “fourth” markets refer to deals made between brokers and institutions via over-the-counter electronic networks, which make them less relevant for individual investors.

Third and Fourth Markets

The terms “third” and “fourth” markets don’t usually concern individual investors because their transactions involve large volumes of shares per trade. Unlike primary and secondary markets, these primarily deal with transactions among broker-dealers and large institutions using over-the-counter electronic networks.

The third market consists of OTC transactions among broker-dealers and large institutions. The fourth market is made up of trades that take place only between large institutions.

The primary reason these third and fourth market trades occur is to avoid these orders going through the main exchange, which can significantly affect the security price in the form of platform charges, etc. Even a tiny margin of individual shares can translate to massive amounts when many shares are involved. Since the third and fourth markets are exclusive, their activities do not concern the average investor.

The OTC market

You may have heard that the dealer market is called the over-the-counter (OTC) market. Originally this term was meant to describe a relatively unorganized system in which trading was not tied down to a physical location but was instead carried out through dealer networks.

The term came into use during the great bull market of the 1920s to describe the booming off Wall Street trading in which “unlisted” shares were traded “over-the-counter” in stock shops. In other words, the stocks being traded were not listed on a stock exchange.

However, the meaning of OTC has changed over the years.

The National Association of Securities Dealers (NASD) made the Nasdaq in 1971 to provide liquidity to the companies that were being traded via dealer networks. At the time, there were few regulations related to trading shares over-the-counter. The NASD sought to improve this, and as the Nasdaq grew over time to become a major exchange, it blurred the understanding of the term over-the-counter.

These days, “over-the-counter” is typically used to refer to stocks that are not being traded on a stock exchange, such as the Nasdaq, American Stock Exchange (AMEX), or NYSE. Instead, the stock is traded on the pink sheets or on the over-the-counter bulletin board (OTCBB).

These networks are not exchanges. Rather, they call themselves providers of pricing data for securities. These companies have few regulations to comply with compared to those using a stock exchange to trade shares. Most securities traded in this manner are penny stocks or are issued by small companies.

Therefore, while the Nasdaq may still be technically considered a dealer market and an OTC, today’s Nasdaq is also a stock exchange meaning it is untrue to say that it deals in unlisted securities.

Key takeaway: primary vs. secondary markets

The defining characteristic of the difference between the primary market and secondary market is that securities in the primary market are purchased directly from the issuer. The primary market does not include transactions involving an intermediary such as a broker, stock exchange, or other institutions.

The example of bonds can illustrate the distinction between the primary and secondary markets. Anyone can buy government-issued bonds as debt security. Purchasing the bond directly from the government means the trade would be considered a part of the primary market. However, suppose the bond is sold for a profit to a third party (as explained above). In that case, the transaction is said to be part of the secondary market because the government, the issuing party, does not play an active role in the transaction.

The bottom line

The important role of primary and secondary markets and the differences in their functions are often overlooked by novice investors. It is why they are easily convinced of investment fraud. Thus, a lack of awareness can hurt and lead to losses, while knowledge about the functioning of the primary and secondary markets can help make a safe investment.