A pullback is a common trading concept widely used to open positions on perfect levels. Pullbacks are also known as retracements and corrections. Pullback trading isn’t complicated if you know some rules.

Rule 1: Identify the overall trend

According to statistics, the success rate of traders who use a trend-following system is around 50%. However, if you learn to trade in a trend, you can increase your chances of getting income.

A price can’t rise or fall permanently; therefore, there are corrections or pullbacks.

A pullback is a short-term price correction within the established trend.

It’s vital to remember that not all moves against the overall trend are pullbacks. If a price moves against the trend so that it turns around, it isn’t a pullback anymore.

Therefore, to trade a pullback successfully, you need to identify the overall trend and trade in its direction. In an uptrend, a pullback occurs when the price moves down. In a downtrend, a pullback is when the price rises. It means you should sell in a downtrend and buy in an uptrend after a pullback.

Rule 2: Place trendlines

The idea of pullback trading is to sell at a higher price in a downtrend and buy at a lower price in an uptrend. The most effective way to identify entry and exit points is to set trendlines.

Placing trendlines is a simple pullback trading strategy. The chart below shows a pullback (1) within a downtrend of the EUR/USD pair. You could sell after the price touched the upper trendline and close the trade at the lower trendline (2).

Rule 3: Use a simple moving average

This is another pullback trading strategy. A simple moving average (SMA) can be used to identify entry points after a pullback occurs. Its period depends on the timeframe you trade on—the lower the timeframe, the smaller the period is. The standard settings are 9, 12, and 21 for short-term periods and 50, 100, and 200 for the long term.

A moving average resembles a trend and moves above the price in a downtrend and below the price in an uptrend. This makes it a useful tool for identifying entry points. Look at the chart above: points 1 and 2 show potential entries for sell trades.

Note: Unlike trendlines which determine precise entry and exit points, the SMA’s accuracy level is much lower.

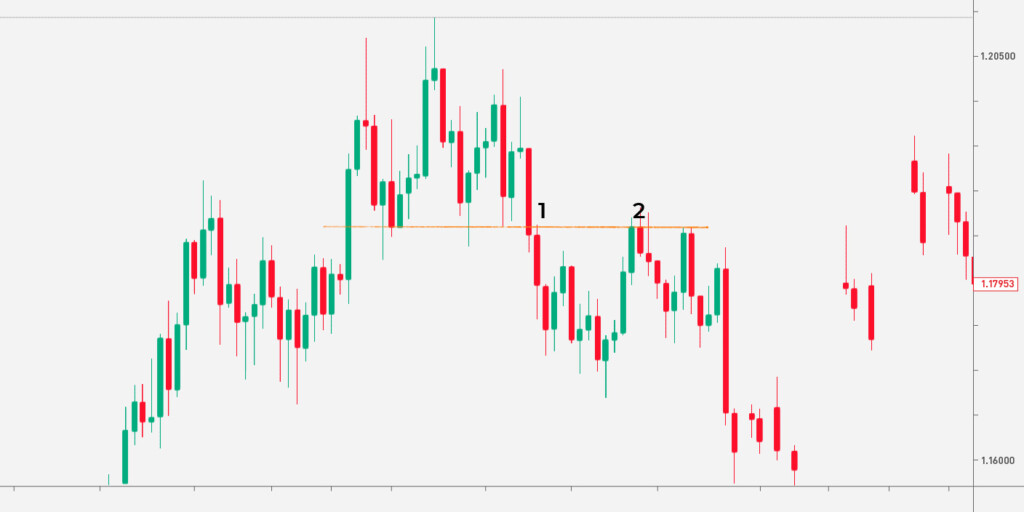

Rule 4: Find breakouts and pullbacks

It’s very common for pullbacks to occur after a breakout.

A breakout is a market condition when a price breaks above a resistance or below a support signaling a trend reversal.

The easiest way to trade a breakout is to find a chart pattern.

On the chart above, there is a head-and-shoulders pattern. The price broke below the neckline (1), signaling a beginning of a downtrend. After, the bulls tried to push the price again (2). However, they failed, and the price continued to decline. You could open a sell trade after the pullback (2).

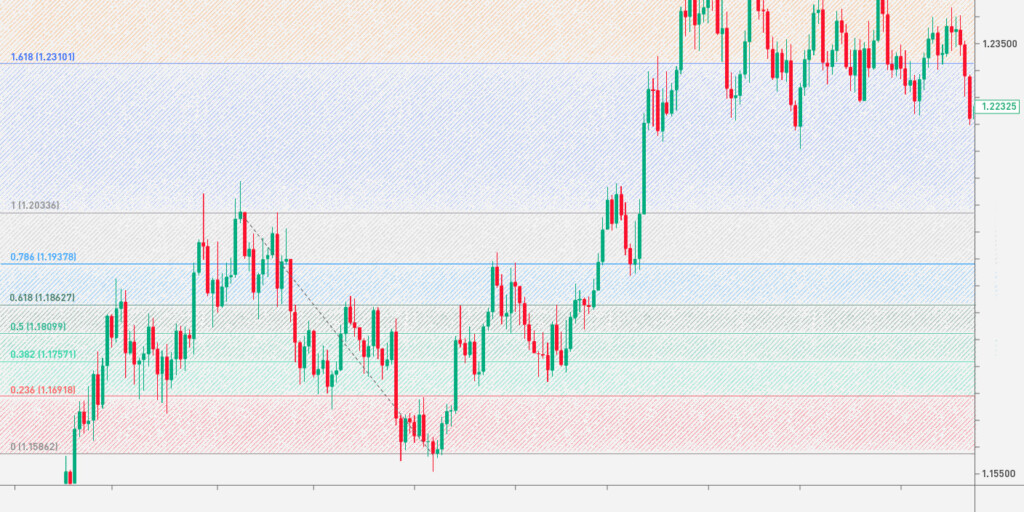

Rule 5: Fibonacci retracement

Fibonacci retracement is another tool you can use to determine pullbacks. The idea is to implement the indicator during a solid trend and wait for the price to rebound from 23.6%, 38.2%, 50% (1), 61.8%, or 78.6% levels.

Rule 6: Enter a trade wisely

It was mentioned you could enter a trade after a pullback. There are two approaches, aggressive and conservative, on when to open a position.

- In an aggressive approach, a trader sets an order immediately after determining a pullback. It’s risky because the price may move beyond the entry point, especially when the market suffers enormous volatility.

- In a conservative approach, a trader opens a position when the price sets a new low (downtrend) or a new high (uptrend) after the pullback.

Takeaway

Pullback trading is an easy strategy, even for beginner traders. If you learn to determine pullbacks, you will trade effectively, entering the market at favorable rates.