The GBP-USD is an essential pair for traders in the market. According to Statista, the USD is the most used currency in the world’s economy. At the same time, the GBP is about the fifth most used currency. Together they account for more than 59% of the world’s financial transactions.

These dynamics make the currency pair gain the attention of beginners and pros. With the government crafting financial changes that have resulted in the volatility of the pound and the banks embarking on an interest hike in 2022, it is obvious that this is the best time to trade the GBP/USD exchange rate. The GBP vs USD currency pair works well for first-time traders and equips investors with the right knowledge on pair volatility and how to respond to it.

How to trade the GBP/USD pair in a volatile market

It is possible to profit from a volatile market when trading the GBP/USD pair. Here’s an illustration that shows you how. If a trade is initiated at 1.2738, and the GBP USD goes up to 1.2758, you would have made 20 pips profit. If the trader buys at the asking price of 1.2737 and the GBP/USD quote moves to 1.2757 Bid / 1.2758 Ask, then the trader can exit at the price (the selling price) of 1.2757. This means the trader would have made 20 pips profit (1.2737 – 1.2757). This way, you can always watch out for potential catalysts to trade a rising market.

What if there is no rising market when trading GBP/USD currency pairs? Not to worry, global traders can likewise profit from a falling market. This can be achieved by initiating a short trade. For comprehension, say you quickly work the British pound against the US dollar at 1.2736, and it falls to 1.2715, you would have made a profit of 20 pips.

Know what moves the market

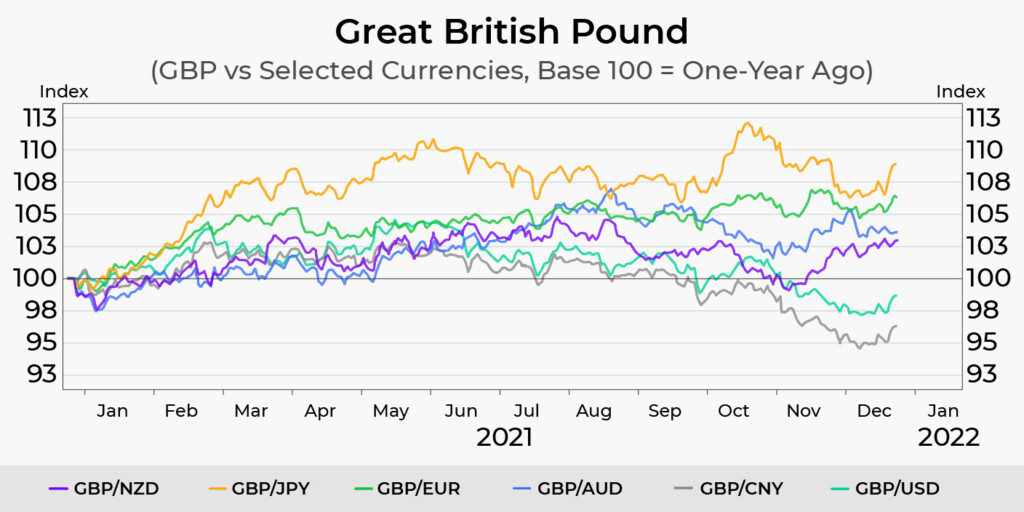

Because the United Kingdom is an enormous trading country, several factors contribute to the market price of GBP against USD. Central bank policy and global demand for the British pound are the most common factors that move this currency pair.

Below are the major indicators to consider when assessing the GBP against the USD exchange rate.

1. The trading market and the GBP-USD range

Whenever there is a global demand for a currency, it is usually because of the strength of the country’s economy. If the economy of the UK is, therefore, strong and the US economy appears weak, it could result in a hike in the GBP/USD currency pair and vice versa.

2. Financial institutions

Whatever outline the banks give can influence the GBP/USD exchange rate positively or otherwise. Once every month, the central bank of the UK meets to publish the Bank of England Monetary Policy Summary report. This report explains why the central bank has decided to increase, cut, or hold interest rates. In a normal economic environment, a currency will fall when there is a threat of the cut of interest rate and will perform well when there is an optimistic rise in interest rate.

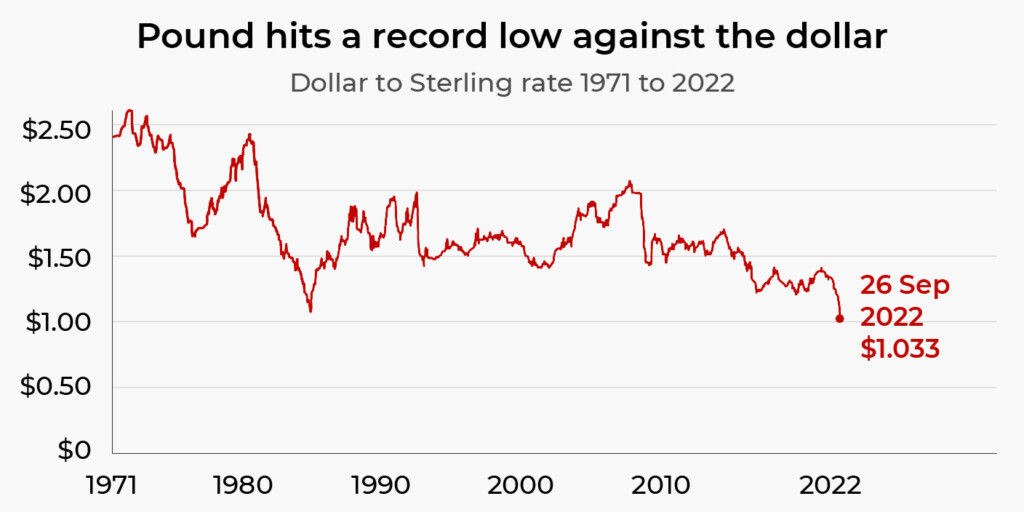

3. Change in leadership

Events such as elections and a change in parties can also influence the price of the GBP/USD currency pair. For instance, prime minister-elect Liz Truss and her Chancellor Kwasi Karteng sent the pound to an all-time low against the US dollar in 37 years. This came after the announcement of the mini-budget, which was taken as a negative one by the market in September 2022.

4. Data of the economy

While other political and fiscal policies can affect the long-term trend of the global market, there is economic data that can alter the price movement of the British pound versus the US dollar within a short time. Important announcements such as inflation, retail sales, and employment figures can cause serious changes in the GBP/USD pair.

5. Trading the GBP/USD exchange rate

One vital trading strategy to profit money from the GBP/USD exchange rate is to focus on what moves the market and plan your strategy around it. Understanding what influences the GBP-USD currency pair is critical whether you’re aiming for short- or long-term investment.

Final remarks

Whether you are a learner or a professional trader, you need to master the GBP-USD pair. When mastered effectively, the GBP-USD trading strategy can help you predict future price movement, reduce the risk of loss and equip you with skills to trade in a volatile market.